(Finance) – Wall Street continues the session at the levels of the eve, after the data on producer prices confirmed the cooling of inflationary pressures in the United States. The slowdown has strengthened expectations among investors for a halt to the Fed’s monetary tightening, after the now discounted hike expected at the July meeting.

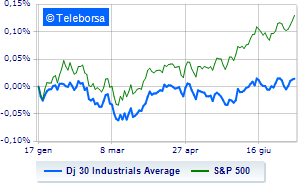

Among US indices, the Dow Jones reports a variation of +0.16%, while, on the contrary, theS&P-500 it advances fractionally, reaching 4,501 points. Up the NASDAQ 100 (+1.43%); with the same direction, climbs theS&P 100 (+0.8%).

In the S&P 500, the performance of the sub-funds was good telecommunications (+2.33%), informatics (+1.14%) and secondary consumer goods (+0.99%). The sector powerwith its -1.05%, is the worst on the market.

To the top between Wall Street giants, Salesforce (+1.34%), cisco systems (+1.32%), Microsoft (+1.04%) and IBM (+1.02%).

The strongest declines, however, occur on Walgreens Boots Alliancewhich continues the session with -1.98%.

They focus their sales on Chevronswhich suffers a drop of 1.65%.

Small loss for Travelers Companywhich trades with -1.17%.

He hesitates Home Depotwhich drops 0.99%.

On the podium of the Nasdaq stocks, PDD Holdings (+5.44%), Zscaler (+4.77%), alphabet (+4.43%) and JD.com (+4.36%).

The strongest sales, on the other hand, show up Fastener Companywhich continues trading at -3.21%.

Sales on Walgreens Boots Alliancewhich records a drop of 1.98%.

Bad sitting for Illuminatewhich shows a loss of 1.57%.

Basically weak Diamondback Energywhich records a decrease of 1.41%.