(Finance) – Positive start for the Wall Street stock exchange with investors worried about the evolution of the war in Ukraine while their attention is catalyzed by inflation, after the words of Bullard. The chairman of the Federal Reserve of Saint Louis it does not rule out interest rate hikes of more than 50 basis points even if it does not deem them necessary.

To this must be added the data arrived at China where is the GDP for the first quarter has grown beyond expectations, but consumption (le retail sales) fell for the first time since 2020, disappointing expectations.

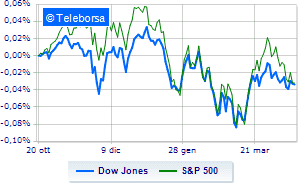

Among the US indices, the Dow Jones is achieving + 0.38%, while, on the contrary, theS & P-500, which continues the session at 4,397 points, on the eve of the day. Just below parity the Nasdaq 100 (-0.34%); almost unchanged theS&P 100 (-0.02%).

Sectors stand out in the S&P 500 basket industrial goods (+ 0.79%), financial (+ 0.58%) e sanitary (+ 0.44%). The sector informaticswith its -0.47%, it is the worst of the market.

At the top of the ranking of American giants components of the Dow Jones, Johnson & Johnson (+ 3.46%), Boeing (+ 2.07%), Nike (+ 1.98%) e DOW (+ 1.43%).

The worst performances, on the other hand, are recorded on Travelers Companywhich gets -4.69%.

Small loss for Salesforcewhich trades with a -0.32%.

To the top between tech giants of Wall Streetthey position themselves Intuitive Surgical (+ 3.98%), Lululemon Athletica (+ 3.29%), Charter Communications (+ 3.04%) e Okta (+ 1.77%).

The worst performances, on the other hand, are recorded on Pinduoduo Inc Spon Each Repwhich gets -4.87%.

Heavy Baiduwhich marks a drop of -3.74 percentage points.

Negative sitting for JD.comwhich falls by 3.70%.

Sensitive losses for NetEasedown 3.42%.

Between the data relevant macroeconomics on US markets:

Wednesday 20/04/2022

4:00 pm USA: Sale of existing homes, monthly (previous -7.2%)

16:30 USA: Oil stocks, weekly (863K barrels expected; previous 9.38 Mln barrels)

Thursday 21/04/2022

14:30 USA: PhillyFed (20 points expected; preceding 27.4 points)

14:30 USA: Unemployment Claims, Weekly (Expected 175K Units; Previously 185K Units)

4:00 pm USA: Leading indicator, monthly (expected 0.3%; previous 0.3%).