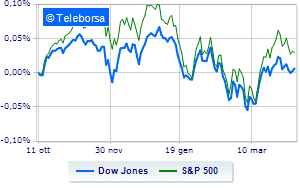

(Finance) – The Wall Street stock market is moving up even if it is starting to close a negative week, due to the new fears on the economy generated above all by a more aggressive Fed.

Among the US indices, the Dow Jones is achieving + 0.68%, while, on the contrary, theS & P-500, which continues the session at 4,503 points, on the eve of the eve. Negative changes for the Nasdaq 100 (-0.94%); on parity theS&P 100 (-0.1%).

Positive result in the S&P 500 basket for sectors power (+ 2.65%), financial (+ 1.09%) e sanitary (+ 0.93%). At the bottom of the ranking, significant falls are manifested in the sector informaticswhich reports a decrease of -0.95%.

Between protagonists of the Dow Jones, Home Depot (+ 2.89%), Goldman Sachs (+ 2.55%), United Health (+ 1.83%) e Chevron (+ 1.57%).

The strongest falls, on the other hand, occur on Applewhich continues the session with -0.98%.

Lazy day for Boeingwhich marks a decrease of 0.90%.

Small loss for Honeywell Internationalwhich trades with a -0.9%.

He hesitates Intelwhich yields 0.82%.

To the top between tech giants of Wall Streetthey position themselves Constellation Energy (+ 5.11%), Regeneron Pharmaceuticals (+ 2.81%), Gilead Sciences (+ 2.67%) e Dollar Tree (+ 2.64%).

The strongest sales, on the other hand, show up on Atlassianwhich continues trading at -5.01%.

At a loss Seagenwhich falls by 4.23%.

Heavy Nvidiawhich marks a drop of -4 percentage points.

Negative sitting for Marvell Technologywhich falls by 3.21%.

Between macroeconomic quantities most important of the US markets:

Friday 08/04/2022

4:00 pm USA: Wholesale stocks, monthly (expected 2.1%; previous 1.2%)

Tuesday 12/04/2022

14:30 USA: Consumption prices, yearly (8.4% expected; previous 7.9%)

14:30 USA: Consumption prices, monthly (expected 1.1%; previous 0.8%)

Wednesday 13/04/2022

14:30 USA: Production prices, monthly (expected 1.1%; previous 0.8%)

14:30 USA: Production prices, annual (expected 10.5%; previous 10%).