(Finance) – Wall Street’s stock market has started to rise as investors try to put the previous negative weeks behind them, with attention focused on the central bankers’ symposium in Jackson Hole.

Insiders will try to understand from the speech of the Fed chairman Jerome Powellscheduled for Friday, August 25, if current monetary policy expectations are justified. The minutes of the last Fed meeting showed that the US central bank could continue to raise interest rates, in the face of inflation that remains at unacceptable levels.

On the corporate front, the banking sector is under pressure after S&P Global cut its rating and revised the outlook of several US banks downwards, a few days after a similar decision taken by Moody’s, warning of liquidity and profitability risks.

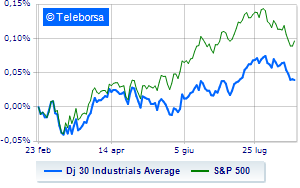

Among US indices, the Dow Jones shows a variation equal to +0.09% while, on the contrary, a small leap forward for theS&P-500, which comes in at 4,413 points. Moderately up the NASDAQ 100 (+0.34%); with similar direction, slightly positive theS&P 100 (+0.32%).

In the S&P 500, the performance of the sub-funds was good materials (+0.62%), industrial goods (+0.55%) and secondary consumer goods (+0.50%).

At the top of the rankings American giants components of the Dow Jones, Salesforce (+2.05%), Microsoft (+1.71%), intel (+1.19%) and Apple (+0.77%).

The strongest sales, on the other hand, show up Johnson & Johnsonwhich continues trading at -2.98%.

Without momentum Nikewhich trades with -1.86%.

Home Depot is stable, reporting a moderate -1.01%.

Cautious tread for Goldman Sachswhich shows a performance of -0.88%.

Between best performers of the Nasdaq 100, Palo Alto Networks (+14.84%), Modern (+9.31%), Nvidia (+8.47%) and Tesla Motors (+7.33%).

The worst performances, however, are recorded on Align Technologywhich gets -2.22%.

Decided decline for Sirius XM Radiowhich marks a -2%.

He hesitates DexComwhich drops 1.29%.

Basically weak Atlassianwhich recorded a decrease of 1.15%.