(Finance) – Positive session on Wall Street, after the publication of the last salient macroeconomic data before the Christmas holidays. Before the market opened, the Bureau of Economic Analysis announced that the core personal consumption expenditures price index – the Fed’s preferred inflation parameter – fell to +3.2% on an annual basis in November (+3.4% the previous month and +3.3% expected).

“There today marks a significant milestone with inflation in the last six months at the pre-pandemic level of 2% – commented the President of the United States, Joe Biden – Americans saw their income grow 3.7% over the past year, adjusted for inflation. As we approach the holidays, prices are down from a year ago on major items including a gallon of gasoline, a gallon of milk, toys, appliances, electronics, car rentals and airline fares.”

Between stories of the day there is the collapse of Nikeafter the sportswear maker said it was targeting cost savings of up to $2 billion in a picture of weaker sales. “We are seeing signs of more cautious consumer behavior around the world,” CFO Matthew Friend said during the call with the financial community.

On the front ofBUT, Bristol Myers Squibbone of the world’s leading pharmaceutical companies, has entered into a definitive merger agreement under which it will acquire Karuna Therapeutic for 330 dollars per share (53% premium compared to the last closing) in cash, for a total equity value of 14 billion dollars.

As regards the new prices, Lionsgate announced today that its Business Studios will list on the Nasdaq via a business combination with SPAC Screaming Eagle Acquisition Corp in a transaction valuing Lionsgate Studios at approximately $4.6 billion.

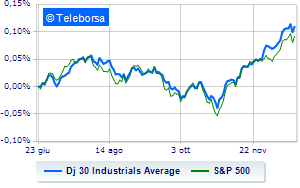

Looking at the main indicesThe Dow Jones stands at 37,445 points, while, on the contrary, theS&P-500 it makes a small leap forward of 0.32%, reaching 4,762 points. Slightly positive Nasdaq 100 (+0.26%); as well, in fractional progress theS&P 100 (+0.24%).

In good evidence in the S&P 500 i compartments utilities (+0.87%), office consumables (+0.85%) e power (+0.76%).

Among the best Blue Chips of the Dow Jones, Intel (+1.93%), Amgen (+1.88%), Wal-Mart (+1.41%) e Merck (+1.41%).

The worst performances, however, are recorded on Nike, which gets -11.00%. Modest descent for Walt Disneywhich drops a small -0.82%.

Between protagonists of the Nasdaq 100, ANSYS (+10.01%), Modern (+5.02%), Intel (+1.93%) e Amgen (+1.88%).

The strongest sales, however, occur at Trade Desk, which continues trading at -4.46%. The negative performance of Synopsyswhich fell by 2.74%. Warner Bros Discovery drops by 2.09%. Decline decided for PDD Holdingswhich marks -1.98%.