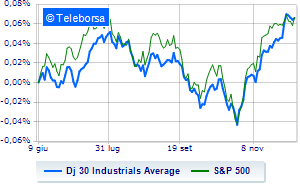

(Finance) – Wall Street continues the session with a fractional gain, after stronger-than-expected labor market data. The Dow Jones by 0.30%; along the same lines, theS&P-500 advances fractionally, reaching 4,603 points.

Slightly positive Nasdaq 100 (+0.38%); as well, in fractional progress theS&P 100 (+0.35%).

Positive result in the S&P 500 basket for sectors power (+1.06%), industrial goods (+0.76%) e materials (+0.72%).

At the top of the rankings American giants components of the Dow Jones, Intel (+1.40%), Caterpillar (+1.26%), Walt Disney (+1.24%) e Goldman Sachs (+1.18%).

The steepest declines, however, occur at Honeywell Internationalwhich continues the session with -1.00%.

Lame Procter & Gamblewhich shows a small decrease of 0.78%.

Modest descent for United Healthwhich drops a small -0.59%.

On the podium of Nasdaq stocks, Warner Bros Discovery (+5.74%), Lululemon Athletica (+2.81%), Paypal (+1.88%) e Nvidia (+1.83%).

The worst performances, however, are recorded on Sirius XM Radiowhich gets -1.80%.

Thoughtful PDD Holdingswith a fractional decline of 1.40%.

He hesitates Enphase Energywith a modest decline of 1.28%.

Slow day for Xcel Energywhich marks a decline of 1.28%.

Among the data relevant macroeconomic factors on US markets:

Friday 08/12/2023

2.30pm USA: Change in employment (expected 180K units; previously 150K units)

2.30pm USA: Unemployment rate (expected 3.9%; previously 3.9%)

4:00 pm USA: Michigan University Consumer Confidence (expected 62 points; previously 61.3 points)

Tuesday 12/12/2023

2.30pm USA: Consumer prices, monthly (prev. 0%)

2.30pm USA: Consumer prices, annual (previously 3.2%).