(Finance) – Wall Street is moving higher after the Fed’s Federal Open Market Committee (FOMC) rate decision and the US central bankers’ forecasts for next year. As expected, rates remained firm for the third consecutive meeting, but the dot plt revealed that the median rate projection for the end of 2024 has fallen to 4.6%, implying three rate cuts of 25 basis points for the next year.

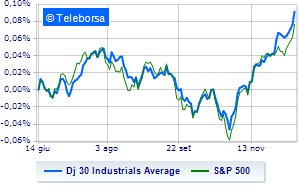

The New York Stock Exchange shows on Dow Jones an increase of 0.58%, continuing the series of five consecutive increases that began last Thursday; along the same lines, theS&P-500 advances fractionally, reaching 4,674 points. Just above parity the Nasdaq 100 (+0.67%); with similar direction, fractional gains for theS&P 100 (+0.51%).

In good evidence in the S&P 500 i compartments utilities (+1.76%), healthcare (+0.93%) e office consumables (+0.91%).

Among the best Blue Chips of the Dow Jones, Walgreens Boots Alliance (+2.25%), Procter & Gamble (+1.59%), Merck (+1.52%) e Apple (+1.23%).

The worst performances, however, are recorded on Verizon Communicationswhich obtains -1.72%.

Slow day for 3Mwhich marks a decline of 0.59%.

Between protagonists of the Nasdaq 100, Vertex Pharmaceuticals (+11.81%), Illuminate (+3.42%), Netflix (+3.01%) e Atlassian (+2.89%).

The strongest sales, however, occur at Modernwhich continues trading at -4.30%.

Under pressure Zoom Video Communicationswhich suffered a decline of 2.30%.

It slides Adobe Systemswith a clear disadvantage of 2.23%.

In red CoStarwhich highlights a sharp decline of 1.96%.