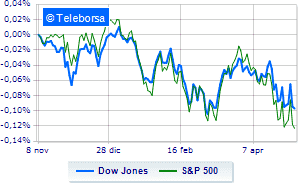

(Finance) – Weak session for the US price listwhich trades with a drop of 0.24% on the Dow Joneswhile, on the contrary, theS & P-500, which continues the day at 4,139 points. In fractional decline the Nasdaq 100 (-0.2%); consolidates the levels of the eve of theS&P 100 (+ 0.03%). However, US stocks recovered from the deep red opening, which followed the sell-off of yesterday’s session. Today, investors find themselves valuing the April job data, which turned out to be firmer than expected. The question is whether a job market showing continued strength could push the Fed to higher interest rate hikes to counteract the rise in prices.

The sectors are in good evidence in the S&P 500 power (+ 2.27%) e utilities (+ 0.51%). In the list, the worst performances are those of the sectors materials (-1.22%), financial (-0.62%) e industrial goods (-0.56%).

Between protagonists of the Dow Jones, Chevron (+ 2.10%), Walgreens Boots Alliance (+ 1.54%), Apple (+ 1.32%) e IBM (+ 0.95%).

The strongest sales, on the other hand, show up on Nikewhich continues trading at -3.00%.

American Express drops by 1.67%.

Decline for Home Depotwhich marks a -1.35%.

Under pressure Walt Disneywith a sharp decline of 1.30%.

Between best performers of the Nasdaq 100, Monster Beverage (+ 5.02%), Mercadolibre (+ 4.56%), Advanced Micro Devices (+ 3.08%) e Datadog (+ 1.97%).

The strongest falls, on the other hand, occur on Illuminatewhich continues the session with -12.65%.

Heavy Lululemon Athleticawhich marks a drop of as much as -6.87 percentage points.

Negative sitting for Crowdstrike Holdingswhich falls by 6.53%.

Sensitive losses for Oktadown 5.79%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Friday 06/05/2022

14:30 USA: Change in employees (expected 391K units; previous 428K units)

14:30 USA: Unemployment rate (expected 3.5%; previous 3.6%)

Monday 09/05/2022

4:00 pm USA: Wholesale stocks, monthly (previous 2.5%)

Wednesday 11/05/2022

14:30 USA: Consumption prices, annual (previous 8.5%)

14:30 USA: Consumption prices, monthly (expected 0.2%; previous 1.2%).