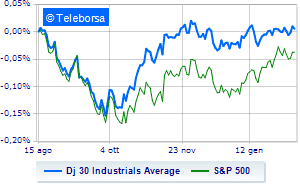

(Finance) – The Wall Street stock exchange is moving at two speeds, at the halfway point, after the publication of inflation which showed a lower than expected slowdown in prices and which could push the Fed to continue the pace of rate hikes .

Among US indices, it moves below parity on Dow Joneswhich drops to 34,116 points, with a percentage difference of 0.38%, while, on the contrary, theS&P-500with the quotations standing at 4,132 points.

In fractional progress the NASDAQ 100 (+0.28%); without direction theS&P 100 (-0.07%).

In the S&P 500, no fund is saved.

Between protagonists of the Dow Jones, boeing (+1.48%), Chevrons (+1.26%), Nike (+0.56%) and Visa (+0.52%).

The worst performances, however, are recorded on Home Depotwhich gets -1.69%.

In red Travelers Companywhich shows a marked decrease of 1.52%.

He hesitates Honeywell Internationalwith a modest drop of 1.34%.

Slow day for Coca Colawhich marks a decrease of 1.31%.

Between protagonists of the Nasdaq 100, global foundries (+7.00%), Cadence Design Systems, (+6.97%), Nvidia (+4.53%) and Tesla Motors (+4.13%).

The strongest sales, on the other hand, show up Enphase Energy,which continues trading at -3.51%.

The negative performance of PayPalwhich drops by 3.08%.

light up, drops by 2.12%.

Decided decline for Dollar Tree,which marks a -1.7%.

Between macroeconomic variables of greatest weight in the North American markets:

Tuesday 02/14/2023

2.30pm USA: Consumption prices, monthly (expected 0.5%; previous 0.1%)

2.30pm USA: Consumption prices, yearly (expected 6.2%; previous 6.5%)

Wednesday 02/15/2023

2.30pm USA: Empire State Index (exp. -17.75 points; previous -32.9 points)

2.30pm USA: Retail Sales, Monthly (exp. 1.6%; previous -1.1%)

2.30pm USA: Retail sales, yearly (previously 6%).