(Finance) – Wall Street has moved little and is set to end the week in declineafter a better-than-expected U.S. jobs report signaled labor market resilience and lowered investor expectations for rapid interest rate cuts by the Federal Reserve.

According to data released by the Department of Labor, 216 thousand were added jobs in the non-agricultural sectors (non-farm payrolls) in December 2023, after 173,000 payrolls were created in November, and compared to market expectations for an increase of 170,000. The unemployment rate remained stable at 3.7%, compared to expectations for a 3.8% increase.

Today’s data, added to the minutes of the latest Fed meeting, has reduced expectations of a rate cut. According to the CME FedWatch Tool, traders see a 63.8% probability for a cut of at least 25 basis points in Marchdown from 73.3% a week ago.

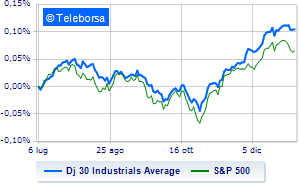

Looking at the main Wall Street indicesThe Dow Jones it stands at 37,369 points on the day before; along the same lines, a day without infamy and without praise for theS&P-500, which remains at 4,694 points. Fractional earnings for the Nasdaq 100 (+0.22%); almost unchangedS&P 100 (+0.2%).

It stands out in the S&P 500 basket sector financial. At the bottom of the ranking, significant declines are evident in the sector office consumableswhich reports a decline of -0.61%.

Between protagonists of the Dow Jones, Verizon Communications (+1.64%), Goldman Sachs (+1.00%), Boeing (+0.93%) e Home Depot (+0.86%).

The steepest declines, however, occur at United Health, which continues the session with -1.97%. Modest descent for McDonald’s, which drops a small -1.32%. Thoughtful Wal-Mart, with a fractional decline of 1.22%. He hesitates Procter & Gamblewith a modest decline of 1.20%.

Between best performers of the Nasdaq 100, Marvell Technology (+3.81%), Modern (+3.21%), Datadog (+2.88%) e Advanced Micro Devices (+2.40%).

The worst performances, however, are recorded on JD.com, which gets -2.03%. They focus on sales PepsiCo, which suffers a decline of 1.88%. Sales up Keurig Dr Pepper, which recorded a decline of 1.85%. Negative session for Polishedwhich shows a loss of 1.67%.