(Tiper Stock Exchange) – Little moved session for Wall Street, with investors finding themselves evaluating a slew of quarterly results and macroeconomic data for clues about the interest rate outlook. Among the largest corporations they have released the results before the bell There are Procter & Gamble (which raised its sales guidance after a quarter above expectations), SLB extension (whose profit jumped 80% in the first quarter and beat expectations) e HCA Healthcare (which raised its estimates of 2023 results on personnel improvement).

There next week it will be there heart of earnings season first quarter results, with results released by three of the four largest US companies by market value – MicrosoftGoogle (alphabet) And Amazon – with Meta Platforms.

On the macroeconomic frontU.S. manufacturing and services activity improved more than expected in April 2023, according to S&P Global PMIs.

Over the past 24 hours, several Fed officials have argued for another interest rate hike, hinting at the possibility of a pause afterward. Loretta Master (Cleveland Fed) reiterated that rates will have to rise above 5%, even if for now it is uncertain how much restriction will be necessary and for how long it will be appropriate to maintain it. Raphael Bostic (Fed Atlanta) confirmed that “further tightening” may be needed and argued for a pause after another hike and Patrick Harker (Philadelphia Fed) said rates are close to where they need to be.

Lisa Cooka member of the Fed’s Board of Governors, will speak today, before US central bank policy makers enter the so-called “blackout period” until the next monetary policy meeting on May 3, for which traders expect the cost of money to rise by 25 basis points.

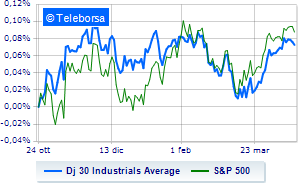

No significant changes for the US price listwith the Dow Jones which stands on the values of the day before at 33,770 points; on the same line, stay flat theS&P-500, with prices standing at 4,130 points. Without direction the NASDAQ 100 (+0.03%); on the same trend, almost unchanged theS&P 100 (+0.1%).

In the S&P 500, the performance of the good compartments secondary consumer goods (+1.20%), office consumables (+0.68%) and sanitary (+0.59%). In the price list, the sectors materials (-1.19%), power (-0.68%) and informatics (-0.47%) are among the best sellers.

To the top between Wall Street giants, Procter & Gamble (+3.76%), Merck (+1.07%), Walt Disney (+0.80%) and Home Depot (+0.54%).

The strongest declines, however, occur on intelwhich continues the session with -1.67%. Dow, drops by 1.61%. Modest descent for boeing, which drops a small -1.34%. Decided decline for Caterpillarwhich marks a -1.16%.

Between protagonists of the Nasdaq 100, Amazon (+3.37%), CSX extension (+3.03%), Gilead Sciences (+1.82%) and DexCom (+1.67%).

The strongest sales, on the other hand, show up AirBnb, which continues trading at -2.92%. Under pressure Zoom Video Communications, with a sharp drop of 2.34%. He suffers JD.com, which shows a loss of 2.13%. Prey of sellers Marvell Technologywith a decrease of 1.82%.