(Finance) – Wall Street is little movedafter that higher-than-expected producer prices in the United States for the month of January have further cooled analysts’ expectations of an imminent interest rate cut by the Federal Reserve this year. Already on Tuesday, an upward surprise in US inflation (CPI up 3.1% year-on-year, higher than forecasts of a 2.9% increase) had entered this narrative.

According to the Department of Labor report released before the bell today, theproducer price index (PPI) rose 0.3% month-over-month in January, compared to the 0.1% increase analysts had expected, and 0.9% year-over-year, compared to estimated growth of 0.6%.

The market expectations for a cut of rates by the Fed a March of at least 25 basis points stand at 9%, according to the CME FedWatch Tool, compared to 63% a month ago, while expectations for a cut to May they fell to 31%, down from 95% a month ago.

Still on the macroeconomic front, a collapse of prices has emerged new construction sites started in the first month of the year, combined with a decline in building permits issued by the competent authorities; furthermore, the consumer confidence Americans, according to preliminary data from the University of Michigan.

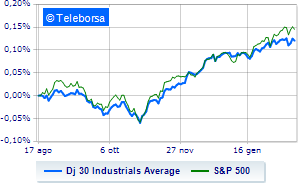

Looking at the main indices of the New York Stock ExchangeThe Dow Jones it stands at the values of the day before at 38,775 points; on the same line, theS&P-500 (New York), which is positioned at 5,032 points, close to previous levels. On equality the Nasdaq 100 (-0.17%); as well, without direction theS&P 100 (-0.01%).

Positive result in the S&P 500 basket for i sectors materials (+1.08%), healthcare (+0.63%) e power (+0.55%). At the bottom of the ranking, significant declines are evident in the sector telecommunicationswhich reports a decline of -1.17%.

To the top between giants of Wall Street, Wal-Mart (+1.35%), Merck (+0.96%), Dow (+0.91%) e IBM (+0.79%).

The steepest declines, however, occur at Nike, which continues the session with -3.17%. Undertone Amgen which shows a filing of 1.30%. Disappointing Cisco Systems, which lies just below the levels of the day before. Lame 3Mwhich shows a small decrease of 0.71%.

Between best performers of the Nasdaq 100, Trade Desk (+19.30%), Applied Materials (+8.25%), KLA-Tencor (+3.24%) e LamResearch (+3.09%).

The worst performances, however, are recorded on DoorDash, which gets -9.11%. Collapses Adobe Systems, with a decline of 5.54%. Decline decided for AirBnb, which marks -2.82%. Under pressure Warner Bros Discoverywith a sharp decline of 2.55%.