(Finance) – The second half of Wall Street it begins in a smooth way and without a clear direction for the main indices. The number one concern always remains that aggressive decisions by central banks to bring runaway inflation under control will end up causing a recession. “For markets to stabilize and sentiment to strengthen, investors will need to see evidence of inflation returning to central bank targets so that central banks can moderate their narrative,” commented Mark Dowding. CIO of BlueBay.

Investors find themselves valuing several macroeconomic data: the Purchasing Managers Index (PMI) manufacturing of the month of June, theISM manufacturing in the same month and the investments used to finance new residential building projects (private and public) in May.

On the corporate announcement front, Kohl’s (US department store chain) announced the failure of exclusive negotiations with Franchise Group to be acquired by the latter, Micron Technology (American semiconductor multinational) released disappointing guidance on cooling the chip market, while NIO, Xpeng And Auto them (Chinese electric vehicle manufacturers) reported increasing sales in June.

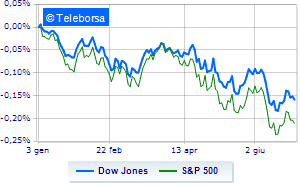

The US list shows a shy gainwith the Dow Jones which is achieving + 0.27%; on the same line, small step forward for theS & P-500, which reaches 3,795 points. On the parity the Nasdaq 100 (-0.15%); slightly positiveS&P 100 (+ 0.21%).

Positive result in the S&P 500 basket for i sectors utilities (+ 1.11%), secondary consumer goods (+ 0.87%) e industrial goods (+ 0.85%).

Between protagonists of the Dow Jones, Home Depot (+ 1.43%), Boeing (+ 1.35%), Procter & Gamble (+ 0.88%) e Caterpillar (+ 0.88%).

The strongest sales, on the other hand, show up on Intelwhich continues trading at -1.95%.

Moderate contraction for Nikewhich suffers a drop of 0.78%.

Undertone Walgreens Boots Alliance which shows a filing of 0.69%.

Disappointing United Healthwhich lies just below the levels of the eve.

Between protagonists of the Nasdaq 100, Pinduoduo Inc Spon Each Rep (+ 3.53%), Datadog (+ 2.82%), Atlassian (+ 2.17%) e JD.com (+ 2.07%).

The strongest falls, on the other hand, occur on Lam Researchwhich continues the session with -4.98%.

Letter on Asml Holding Nv Eur0.09 Ny Registrywhich records a significant decline of 4.08%.

Goes down Micron Technologywith a drop of 3.67%.

Collapses KLA-Tencorwith a decrease of 3.64%.

Between macroeconomic quantities most important of the US markets:

Friday 01/07/2022

15:45 USA: Manufacturing PMI (preceding 57 points)

4:00 pm USA: ISM manufacturing (expected 54.9 points; preceding 56.1 points).