(Finance) – Wall Street crosses the mid-session milestone nervously waiting for the Federal Reserve to hike rates. The profit warning launched by Walmart which lowered the growth estimate until the end of 2022. Investors are now looking with particular interest at the first quarterly reports of Big Tech, such as Microsoft and Google (Alphabet), which will present the results at the close of the markets.

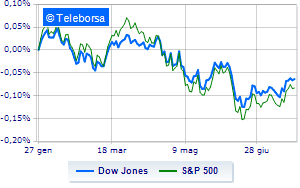

Among the US indices, the Dow Jones it is leaving 0.46% on the parterre; on the same line, a bad day for theS & P-500, which continues the session at 3,925 points, down 1.06%. Heavy on Nasdaq 100 (-1.75%); on the same trend, negative theS&P 100 (-1.29%).

In the S&P 500, the sub-funds performed well sanitary (+ 0.76%) e utilities (+ 0.55%). Among the worst on the list of the S&P 500 basket, the sectors showed the greatest decline secondary consumer goods (-3.06%), telecommunications (-1.66%) e informatics (-1.59%).

At the top of the ranking of American giants components of the Dow Jones, 3M (+ 6.10%), McDonald’s (+ 2.90%), Coke (+ 1.84%) e Amgen (+ 1.56%).

The worst performances, on the other hand, are recorded on Wal-Martwhich gets -7.67%.

Sales hands on Microsoftwhich suffers a decrease of 3.26%.

Bad performance for Salesforcewhich recorded a decline of 3.18%.

Black session for Nikewhich leaves a loss of 3.09% on the table.

On the podium of the Nasdaq titles, Seagen (+ 4.77%), Fiserv (+ 3.93%), Biogen (+ 2.97%) e Cadence Design Systems (+ 2.08%).

The strongest sales, on the other hand, show up on Zscalerwhich continues trading at -8.01%.

At a loss Fortinetwhich falls by 7.46%.

Heavy Palo Alto Networkswhich marks a drop of as much as -6.86 percentage points.

Negative sitting for Crowdstrike Holdingswhich falls by 6.65%.

Between macroeconomic quantities most important of the US markets:

Tuesday 26/07/2022

15:00 USA: FHFA house price index, monthly (previous 1.5%)

15:00 USA: S&P Case-Shiller, annual (expected 20.6%; previous 21.2%)

4:00 pm USA: New house sales, monthly (previously 6.3%)

4:00 pm USA: Consumer confidence, monthly (expected 97.2 points; preceding 98.4 points)

4:00 pm USA: Sale of new homes (expected 660K units; previous 642K units).