(Finance) – The Wall Street stock exchange continues without major jolts and with the spotlight on the Federal Open Market Committee (Fomc) meeting which will end tomorrow Wednesday 15 June and according to expectations it could decide to raise the bar and cut interest rates of 75 basis points and not 50 points as in May.

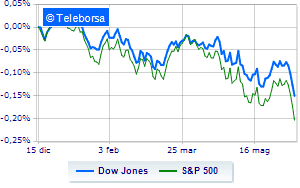

Among the US indices, it moves below parity on Dow Joneswhich drops to 30,354 points, with a percentage difference of 0.53%: theAmerican index thus continues a negative series, which began last Wednesday, of five consecutive declines; on the same line, theS & P-500which loses 0.32%, trading at 3,738 points.

Slightly positive the Nasdaq 100 (+ 0.3%); consolidates the levels of the eve of theS&P 100 (-0.18%).

In the S&P 500, the sub-funds performed well power (+ 1.45%) e informatics (+ 0.42%). In the lower part of the ranking of the S&P 500 basket, significant falls are manifested in the sectors utilities (-3.13%), consumer goods for the office (-1.64%) e sanitary (-1.19%).

Between protagonists of the Dow Jones, Boeing (+ 1.99%), Chevron (+ 1.46%), McDonald’s (+ 1.26%) e Goldman Sachs (+ 1.00%).

The strongest sales, on the other hand, show up on Procter & Gamblewhich continues trading at -3.53%.

Black session for Cokewhich leaves a 3.26% loss on the table.

At a loss Walt Disneywhich falls by 2.44%.

Negative sitting for United Healthwhich shows a loss of 1.99%.

To the top between tech giants of Wall Streetthey position themselves Pinduoduo Inc Spon Each Rep (+ 11.94%), JD.com (+ 7.04%), Baidu (+ 6.40%) e Zoom Video Communications (+ 4.57%).

The strongest falls, on the other hand, occur on Exelonwhich continues the session with -3.63%.

Heavy Xcel Energywhich marks a drop of -3.17 percentage points.

Negative sitting for American Electric Powerwhich falls by 2.94%.

Sensitive losses for Constellation Energydown 2.92%.

Between macroeconomic quantities most important of the US markets:

Tuesday 14/06/2022

14:30 USA: Production prices, monthly (expected 0.8%; previous 0.4%)

14:30 USA: Production prices, annual (expected 10.9%; previous 10.9%)

Wednesday 15/06/2022

14:30 USA: Empire State Index (expected 4.5 points; previous -11.6 points)

14:30 USA: Export prices, monthly (expected 1.4%; previous 0.6%)

14:30 USA: Retail sales, annual (previous 8.2%).