(Tiper Stock Exchange) – Wall Street moves down after the data on producer prices stronger than expected they fed the worries about sticky inflation in the largest economy in the world. On the other hand, positive news came from the consumer price index yesterday, with headline inflation rising less than expected in July on an annual basis, reinforcing projections that the Federal Reserve could soon end its long campaign of policy tightening monetary.

The president of the Federal Reserve Bank of San Francisco, Mary Dalystated that the Fed still has work to do to control inflation, despite the encouraging data for July. The consumer price data “came in largely as expected, and that’s good news,” Daly said in an interview with Yahoo! Finance. “It’s not a data point that says the win is ours. There’s still a lot of work to do. And the Fed is fully committed to getting inflation back to its 2% target.”

Meanwhile, the season of quarterly is coming to an end. Among the most interesting data released in these hours are those of News Corpa media conglomerate founded by Rupert Murdoch, which reported falling data in the last financial year, signaling however a good performance of the Dow Jones division.

Among others corporate announcements, Cano Health communicated the cut of 17% of the workforce and expressed the will to arrive at a sale of the company, while Archer Aviation made a series of announcements solidifying its path to FAA certification and commercial operations in 2025.

As for the titles affected by the analyst recommendations, Rivian Automotive benefits from Exane BNP Paribas upgrade to Outperform from Neutral, Digital Ocean benefits from Morgan Stanley’s upgrade to Equal weight from Underweight, e Capri Holdings suffers Wells Fargo downgrade to equal weight from overweight following yesterday’s announcement that tapestry announced its acquisition.

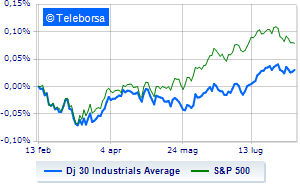

Looking to main indicesThe Dow Jones stands at 35,144 points, while, on the contrary, theS&P-500, which continues the day below parity at 4,453 points. Just below parity the NASDAQ 100 (-0.65%); on the same trend, under parity theS&P 100which shows a decline of 0.43%.