(Tiper Stock Exchange) – Wall Street is not responding clearly to the Fed’s decision raise the key rate by 25 basis points, as planned, up to the target range of 4.5%-4.75%. This is a step back from the 50 basis point increase in December and the four consecutive 75 basis point moves implemented previously. The statement released at the end of the monetary policy meeting repeats the previous language according to which Ongoing increases in key rate will be appropriatewhile adding that the US central bank will consider “the extent of future hikes”.

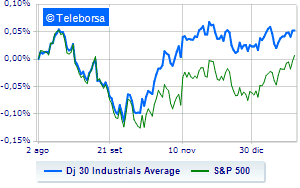

The Dow Jones accuses a drop of 0.75%, while, on the contrary, theS&P-500, which continues the day at 4,070 points. In fractional progress the NASDAQ 100 (+0.3%); without direction theS&P 100 (-0.09%).

On the macroeconomic front, the performance of the new jobs in the US private sector as of January 2023, according to the Automated Data Processing (ADP) report.

At the top of the rankings American giants components of the Dow Jones, Salesforce (+1.11%), boeing (+0.72%) and Johnson & Johnson (+0.53%).

The worst performances, however, are recorded on Amgen, which gets -3.29%. He suffers Travelers Company, which shows a loss of 2.95%. Prey of sellers Chevrons, with a decrease of 2.06%. They focus their sales on Caterpillarwhich suffers a drop of 2.03%.

On the podium of the Nasdaq stocks, Baidu (+11.61%), Old Dominion Freight Line, (+9.58%), Advanced Micro Devices (+8.59%) and Pinduoduo, Inc. Sponsored Adr (+3.68%).

The strongest sales, on the other hand, show up Electronic Arts, which continues trading at -11.72%. At a loss match groups,, which drops by 8.07%. Heavy Modern, which marks a drop of as much as -3.86 percentage points. Sales on Astrazenecawhich records a drop of 3.57%.