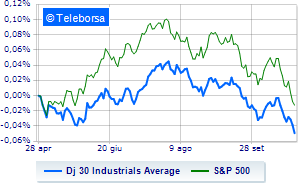

(Finance) – A contrasting session for the Wall Street stock exchange, with the Dow Jones which is leaving 0.99% on the floor; on the same line, theS&P-500, which relegates to 4,115 points. In fractional progress the Nasdaq 100 (+0.38%); slightly decreasingS&P 100 (-0.3%).

Continue to stay high there tension in the Middle Eastwhile the project continues at full speed quarterly season which saw Amazon triple its profit and increase its turnover with e-commerce and advertising. On the economic front, PCE inflation in the United Statesa measure closely monitored by the Fed, showed that prices cooled in September as consumer spending strengthened, easing pressure for a rate hike at its next meeting.

The sectors highlighted on the North American S&P 500 list secondary consumer goods (+2.06%) e informatics (+0.46%). At the bottom of the S&P 500 ranking, significant declines are evident in the sectors power (-2.44%), utilities (-1.88%) e financial (-1.65%).

At the top of the rankings American giants components of the Dow Jones, Intel (+10.07%), Microsoft (+1.36%), Honeywell International (+1.15%) e Boeing (+0.69%).

The steepest declines, however, occur at Chevronwhich continues the session with -5.53%.

Under pressure JP Morganwith a sharp decline of 2.69%.

He suffers Verizon Communicationswhich highlights a loss of 2.52%.

Prey for sellers Amgenwith a decrease of 2.23%.

Between best performers of the Nasdaq 100, DexCom (+10.65%), Intel (+10.07%), Amazon (+7.59%) e Advanced Micro Devices (+3.54%).

The worst performances, however, are recorded on Enphase Energywhich obtains -14.72%.

Sales galore Charter Communicationswhich suffers a decrease of 8.87%.

Bad performance for Modernwhich recorded a decline of 3.90%.

They focus on sales Biogenwhich suffers a drop of 2.40%.