(Finance) – The New York Stock Exchange pauses around parity, with the attention of investors which always remains focused on the central banks that they bet on a less aggressive Fed in light of the latest economic data.

Meanwhile, insiders are also eyeing the now-in-heated US earnings season which will give a clearer picture of the state of the US economy. Among the accounts on the agenda today, the most eagerly awaited balance is that of Microsoft which will be published after the markets close.

The technical problems at the Nyse that occurred in the first few minutes of trading and which caused the suspension of dozens of stocks have been resolved. Among those stopped are the companies Morgan Stanley, Verizon, AT&T extension, Nike And McDonald’saccording to the Nyse website, which then resumed trading at 9.45 (15.45 in Italy).

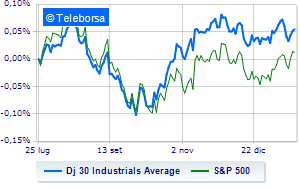

Among US indices, the Dow Jones it stands at 33,632 points; along the same lines, a day without infamy and without praise for theS&P-500, which remains at 4,013 points. Slightly negative the NASDAQ 100 (-0.3%); as well as, slightly down theS&P 100 (-0.21%).

Negative performance in the States on all sectors of the S&P 500.

Among the best Blue Chips of the Dow Jones, Travelers Company (+2.66%), Caterpillar (+1.84%), American Express (+1.52%) and JP Morgan (+1.16%).

The strongest sales, on the other hand, show up 3Mwhich continues trading at -5.64%.

They focus their sales on Merckwhich suffers a drop of 2.10%.

Sales on Walgreens Boots Alliance,which records a drop of 1.98%.

Moderate contraction for Johnson & Johnsonwhich suffers a drop of 1.30%.

On the podium of the Nasdaq stocks, Paccar (+6.61%), Monster Beverage (+2.70%), Align Technology, (+2.30%) and Seagen, (+1.90%).

The worst performances, however, are recorded on Advanced Micro Deviceswhich gets -2.91%.

Bad sitting for Atlassianwhich shows a loss of 2.67%.

Under pressure Astrazenecawhich shows a drop of 2.35%.

Slide document sign,with a clear disadvantage of 2.13%.

Among the data relevant macroeconomics on US markets:

Tuesday 24/01/2023

3.45pm USA: Composite PMI (previously 45 points)

3.45pm USA: Manufacturing PMI (exp. 46 points; previous 46.2 points)

3.45pm USA: PMI services (expected 45 points; previous 44.7 points)

Wednesday 01/25/2023

4.30pm USA: Oil Inventories, Weekly (Exp -593K barrels; prev 8.41M barrels)

Thursday 26/01/2023

2.30pm USA: GDP, quarterly (exp. 2.6%; previous 3.2%).