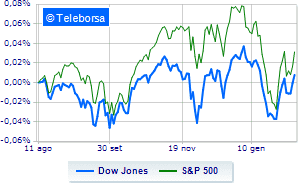

(Finance) – Wall Street crosses the mid-session target in decline, after above-expectations inflation recorded the largest annual increase since 1982 and, fears of restrictive accelerations on the side of the Federal Reserve.

Among the US indices, the Dow Jones accuses a decline of 0.73%; on the same line, theS & P-500, which falls back to 4,541 points, retracing by 1.00%. The Nasdaq 100 (-1.54%); on the same line, negative theS&P 100 (-1.17%).

Positive result in the S&P 500 basket for the sector materials. Among the worst on the list of the S&P 500 basket, the sectors showed the greatest decline utilities (-2.00%), Informatics (-1.80%) e telecommunications (-1.13%).

Between protagonists of the Dow Jones, Walt Disney (+ 3.56%), Boeing (+ 2.51%), Coca Cola (+ 1.46%) e JP Morgan (+ 0.94%).

The strongest falls, on the other hand, occur on Amgenwhich continues the session with -2.72%.

Letter on Microsoftwhich recorded a significant decrease of 2.43%.

Suffers Cisco Systemswhich shows a loss of 1.79%.

Prey of the sellers Visawith a decrease of 1.75%.

Between protagonists of the Nasdaq 100, Mattel (+ 8.18%), Micron Technology (+ 4.40%), O’Reilly Automotive (+ 3.29%) e CHRobinson (+ 1.98%).

The strongest falls, on the other hand, occur on Garminwhich continues the session with -6.00%.

It sinks Adobe Systemswith a drop of 3.68%.

Collapses Autodeskwith a decrease of 3.52%.

Sales hands on Qualcommwhich suffers a decrease of 3.27%.