(Finance) – Wall Street crosses the milestone in the mid-session with declines, as investors look to the crucial vote in the House, expected tonight, on the agreement to raise the US debt ceiling. In the event of a positive vote, it will then be the turn of the Senate.

In the background the question of central banks always remains: tonight the Federal Reserve’s Beige Book will be published, the periodic look at the conditions of the regional districts.

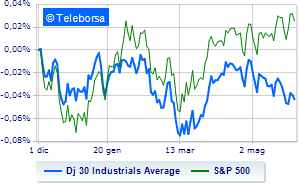

Among US indices, it moves below parity on Dow Jones, which drops to 32,833 points, with a percentage gap of 0.63%; along the same lines, theS&P-500 it lost 0.71%, continuing the session at 4,175 points. In red the NASDAQ 100 (-0.71%); on the same trend, slightly negative theS&P 100 (-0.63%).

Positive result in the S&P 500 basket for the sector utilities. In the list, the worst performances are those of the sectors secondary consumer goods (-1.86%), power (-1.76%) and financial (-1.58%).

At the top of the rankings American giants components of the Dow Jones, intel (+4.35%), Verizon Communication (+2.69%), Merck (+1.12%) and Walgreens Boots Alliance (+1.00%).

The strongest declines, however, occur on 3Mwhich continues the session with -2.64%.

Little moved Home Depotwhich shows a 0%.

Basically unchanged JP Morganwhich reports a moderate 0%.

He suffers Honeywell Internationalwhich shows a loss of 1.90%.

Between best performers of the Nasdaq 100, intel (+4.35%), DexCom (+3.00%), Intuition (+2.84%) and Atlassian (+2.65%).

The strongest declines, however, occur on Marvell Technologywhich continues the session with -6.44%.

Hands-on sales Micron Technologywhich suffers a decrease of 4.67%.

Bad performance for Nvidiawhich records a drop of 4.62%.

Black session for Advanced Micro Deviceswhich leaves a loss of 4.53% on the table.

Among the data relevant macroeconomics on US markets:

Wednesday 05/31/2023

3.45pm USA: PMI Chicago (exp. 47 points; previous 48.6 points)

Thursday 01/06/2023

1.30pm USA: Challenger Layoffs (previously 67K units)

2.15pm USA: Occupied ADP (expected 170K units; previous 296K units)

2.30pm USA: Unit Labor Cost, Quarterly (Expected 6.1%; Previous 3.3%)

2.30pm USA: Productivity, Quarterly (Expected -2.6%; Previous 1.6%).