(Tiper Stock Exchange) – Wall Street continues trading in sharp declineaffected by thesoaring oil prices over 90 dollars a barrel, due to the rationing announced by OPEC+. The increase in the cost of energy could in fact revitalize inflation and convince central banks to proceed with new monetary tightening.

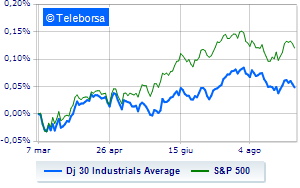

In New York, it moves below par on Dow Jones, which drops to 34,406 points, with a percentage gap of 0.68%; bad day forS&P-500, which continues the session at 4,457 points, down 0.90%. Down the NASDAQ 100 (-1.15%); with similar direction, negative theS&P 100 (-1.16%).

Negative result on Wall Street for all sectors of the S&P 500. In the lower part of the S&P 500 classification, significant declines occur in informatics (-1.65%), secondary consumer goods (-1.21%) and telecommunications (-0.87%).

At the top of the rankings American giants components of the Dow Jones, Wal-Mart (+1.07%) and Salesforce (+0.78%).

The strongest declines, however, occur on Applewhich continues the session with -3.47%.

In red boeingwhich shows a marked decrease of 2.42%.

The negative performance of Amgenwhich drops by 2.07%.

He hesitates McDonald’swith a modest drop of 1.44%.

Between protagonists of the Nasdaq 100, DexCom (+7.69%), Charter Communications (+2.27%), Comcast Corporation (+1.12%) and Tradedesk (+1.03%).

The strongest sales, on the other hand, show up Enphase Energywhich continues trading at -4.29%.

Apple drops by 3.47%.

Decided decline for Zscalerwhich marks a -3.08%.

Under pressure polishwith a sharp drop of 3.03%.