(Finance) – The Wall Street stock exchange starts the last session of the week in the red with American inflation galloping and flying in May reaching the highest levels of the last 40 years. In particular, services, energy and food have contributed to boosting prices. Over the past year, energy prices have increased by 34.6%, those of food by 10.1%, the highest figures since September 2005 and March 1981, respectively.

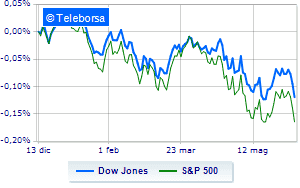

On the first observations, the Dow Jones shows a decrease of 1.49%, continuing on the downward trend represented by three consecutive drops, in existence since last Wednesday; on the same line, day to forget forS & P-500, which falls back to 3,953 points, retracing by 1.61%. Heavy on Nasdaq 100 (-2.03%); on the same line, depressed theS&P 100 (-1.68%).

Strong nervousness and generalized losses in the S&P 500 across all sectors, without exclusion. At the bottom of the ranking, the largest falls are manifested in the sectors secondary consumer goods (-2.43%), materials (-2.26%) e financial (-2.12%).

All the Dow Jones Blue Chips are losing ground on Wall Street.

The strongest falls occur on Boeingwhich continues the session with -3.62%.

Letter on American Expresswhich records a significant decline of 2.38%.

Goes down Walt Disneywith a decline of 2.31%.

Collapses Goldman Sachswith a decrease of 2.25%.

Between best performers of the Nasdaq 100, Pinduoduo Inc Spon Each Rep (+ 7.00%), JD.com (+ 4.40%), NetEase (+ 4.23%) e Baidu (+ 2.74%).

The strongest sales, on the other hand, show up on Docusignwhich continues trading at -23.18%.

Sales hands on Illuminatewhich suffers a decrease of 12.32%.

Bad performance for Netflixwhich recorded a drop of 4.65%.

Black session for Booking Holdingswhich leaves a loss of 4.34% on the table.

Between macroeconomic variables most important in the North American markets:

Friday 10/06/2022

14:30 USA: Consumption prices, yearly (8.3% expected; 8.3% before)

14:30 USA: Consumption prices, monthly (expected 0.7%; previous 0.3%)

4:00 pm USA: University of Michigan Consumer Trust (expected 58 points; preceding 58.4 points)

Tuesday 14/06/2022

14:30 USA: Production prices, monthly (previous 0.5%)

14:30 USA: Production prices, annual (previous 11%).