(Finance) – A downward start for the Wall Street stock exchange with investors’ attention focused on the “hawkish” positions of central bankers. Isabel Schnabel, ECB Executive Board Member believes a rate hike of 50 basis points in March is necessary, but so do some Fed officials, such as Bullard and Master they have returned to forecasting rates above 5% for a long time.

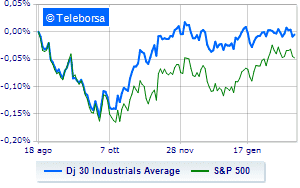

Among US indices, the Dow Jones which is leaving 0.32% on the floor; on the same line, theS&P-500, which recedes to 4,062 points. Negative the NASDAQ 100 (-1%); along the same lines, negative changes for theS&P 100 (-0.8%).

Only Blue Chip of the Dow Jones in substantial increase is cisco systems (+5.24%).

The strongest sales, on the other hand, show up Walt Disneywhich continues trading at -3.12%.

Under pressure Microsoftwhich shows a drop of 2.66%.

Flat Nikewhich holds parity.

Slide Amgenwith a clear disadvantage of 2.43%.

Between protagonists of the Nasdaq 100, Seagen, (+13.28%), cisco systems (+5.24%), JD.com (+3.58%) and Pdd Holdings Inc Sponsored Adr (+2.47%).

The strongest sales, on the other hand, show up Datadogwhich continues trading at -7.04%.

Goes down Enphase Energy,with a drop of 6.92%.

It collapses zscaler,with a decrease of 6.89%.

Hands-on sales Atlassianwhich suffers a decrease of 6.78%.

Among the data relevant macroeconomics on US markets:

Friday 02/17/2023

2.30pm USA: Export Prices, Monthly (exp. -0.2%; previous -3.2%)

2.30pm USA: Import prices, monthly (exp. -0.2%; previous -0.1%)

4:00 pm USA: Leading indicator, monthly (exp. -0.3%; previous -1%)

Tuesday 02/21/2023

3.45pm USA: Manufacturing PMI (previously 46.9 points)

3.45pm USA: PMI services (previous 46.8 points).