(Finance) – The Wall Sreet stock market is starting to decline after the much above expectations on new jobs in the United States reinforced the hypothesis of a faster-than-expected monetary tightening by the Federal Reserve. The prospect of a more aggressive central bank on interest rate hikes reinforces the dollar.

528,000 jobs (excluding agriculture) were created in July compared to the previous month, while analysts expected an increase of 258,000. Unemployment fell to 3.5%, below the consensus expectations which had predicted a 3.6% figure.

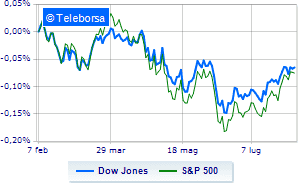

Among the US indices, the Dow Jones, which drops to 32,593 points, with a percentage difference of 0.41%; along the same lines, widespread sales onS & P-500, which continues the day at 4,122 points. In red the Nasdaq 100 (-1.33%); on the same trend, downhill theS&P 100 (-0.78%).

The sector is highlighted on the North American S&P 500 list power. In the list, the worst performances are those of the sectors telecommunications (-1.47%), secondary consumer goods (-1.45%) e informatics (-1.14%).

At the top of the ranking of American giants components of the Dow Jones, JP Morgan (+ 1.48%), Chevron (+ 1.02%), Caterpillar (+ 0.78%) e Travelers Company (+ 0.68%).

The strongest sales, on the other hand, show up on Salesforcewhich continues trading at -2.16%.

Goes down Walt Disneywith a drop of 2.08%.

In red Microsoftwhich shows a marked decrease of 1.24%.

The negative performance of Cisco Systemswhich falls by 1.22%.

Between best performers of the Nasdaq 100, Atlassian (+ 9.18%), Constellation Energy (+ 7.31%), Vertex Pharmaceuticals (+ 2.48%) e Exelon (+ 0.91%).

The strongest sales, on the other hand, show up on Monster Beveragewhich continues trading at -5.75%.

Collapses Oktawith a decrease of 3.44%.

Sales hands on Pinduoduo Inc Spon Each Repwhich suffers a decrease of 3.34%.

Bad performance for Align Technologywhich recorded a decline of 3.33%.

Between macroeconomic quantities most important of the US markets:

Friday 05/08/2022

14:30 USA: Change in employees (expected 250K units; previous 398K units)

14:30 USA: Unemployment rate (expected 3.6%; previous 3.6%)

Thursday 11/08/2022

14:30 USA: Unemployment Claims, Weekly.