(Finance) – Negative session for Wall Streetwith i peace talks between Ukraine and Russia which have shown little progress on key issues and the continued growth in consumer prices (with increasing probability that the Fed will raise rates in its next meeting. On the macroeconomic front, unemployment claims in the US started to rise again, while inflation continued to run in February (+ 7.9% on an annual basis, a new 40-year high). “The confirmation of the February inflation data in line with the consensus, points towards thehypothesis to start the upside phase with 25bps on March 16th – commented Antonio Cesarano, Chief Global Strategist of Intermonte – Traders are currently incorporating expectations of around 6 hikes in 2022. At the same time, however, the long phase of negative real wages continues as wage increases fail to keep pace with inflation, which could impact in significantly on growth in the coming months “.

Meanwhile, the US Secretary of the Treasury, Janet Yellenstated that the sanctions financial taxes imposed on Russia are limiting China’s ability to buy Russian oil and that Beijing is not “compensating or significantly reducing” the pressure on Moscow in terms of sanctions. “My feeling is that financial institutions in China that do business in dollars and euros fear the impact of sanctions,” she said in an interview with the Washington Post.

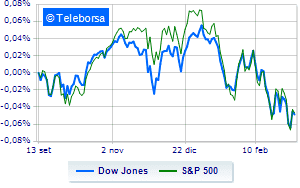

Negative session for Wall Street, with the Dow Jones which is leaving 1.14% on the parterre; on the same line, theS & P-500, which slips to 4,220 points. In sharp decline the Nasdaq 100 (-2.23%); on the same line, downhill theS&P 100 (-1.43%). In the S&P 500, the sub-fund performed well power. In the lower part of the ranking of the S&P 500 basket, significant falls are manifested in the sectors Informatics (-3.03%), financial (-1.77%) e telecommunications (-1.57%).

Between protagonists of the Dow Jones, Chevron (+ 2.30%) e Wal-Mart (+ 1.55%).

The worst performances, on the other hand, are recorded on Applewhich gets -4.09%.

Sensitive losses for Inteldown 2.93%.

Breathless Procter & Gamblewhich falls by 2.82%.

Thud of Cisco Systemswhich shows a fall of 2.61%.

On the podium of the Nasdaq titles, Crowdstrike Holdings (+ 13.25%), Amazon (+ 4.45%), Ebay (+ 1.68%) e Charter Communications (+ 0.91%).

The strongest sales, on the other hand, show up on Pinduoduo Inc Spon Each Repwhich continues trading at -18.23%.

Letter on JD.comwhich records a significant drop of 17.77%.

Goes down NetEasewith a fall of 7.75%.

Collapses Baiduwith a decrease of 7.36%.