(Finance) – The falls on the American stock market continue, with the strongest decline still being that of Nasdaq, entered into correction and weighed down by the collapse of Netflix, which disappointed analysts last night with regards to new subscribers at the end of last year and the outlook for early 2022. The index, filled with tech stocks, has been under pressure since Treasury expectations of a more aggressive Federal Reserve in controlling inflation have risen sharply.

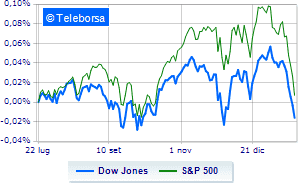

Meanwhile, moves below par the Dow Jones, which drops to 34,530 points, with a percentage gap of 0.54%, continuing on the bearish trail represented by six consecutive drops, in existence since the 13th of this month; on the same line, theS & P-500, which slips to 4,441 points. In descent the Nasdaq 100 (-1.33%); with analogous direction, negative theS&P 100 (-1.06%). All sectors slide on the American S&P 500 price list. In the list, the worst performances are those of the sectors telecommunications (-2.52%), secondary consumer goods (-1.80%) e materials (-1.61%).

It bounces Peloton, which yesterday lost 23% after speculation was spread that will temporarily stop production of its products due to the decline in post-pandemic demand, it took profits on Schlumberger, which saw a jump in quarterly profits thanks to demand for oil services, and positive Intel, which announced a investment of over 20 billion dollars for the construction of two new state-of-the-art chip factories in Ohio.

Between protagonists of the Dow Jones, Nike (+ 1.33%), McDonald’s (+ 1.05%), Intel (+ 0.80%) e Procter & Gamble (+ 0.55%).

The strongest falls, on the other hand, occur on Walt Disney, which continues the session with -5.90%.

Sales hands on Boeing, which suffers a decrease of 3.16%.

Bad performance for Visa, which recorded a decline of 2.18%.

It slips Cisco Systems, with a clear disadvantage of 1.69%.

Between best performers of the Nasdaq 100, Xilinx (+ 3.01%), Nxp Semiconductors NV (+ 2.24%), Texas Instruments (+ 2.05%) e Marriott International (+ 1.79%).

The worst performances, on the other hand, are recorded on Netflix, which gets -21.11%.

Black session for Garmin, which leaves a loss of 9.04% on the table.

In free fall Intuitive Surgical, which sinks by 7.49%.

Heavy Mattel, which marks a drop of -6.1 percentage points.