(Finance) – The stars and stripes indices worsen around the halfway point, with the dynamics that remain conditioned by the war in Ukraine to which is added the protraction of the new lockdown in Shanghai which raises fears of slowdowns in China and new problems on the chains of worldwide sourcing.

Technology stocks remain in the market spotlight after that Twitter accepted Elon Musk’s $ 44 billion offer. The first quarterly reports of the big techs are also expected: after the closing of the markets, we start with those of Alphabet And Microsoft.

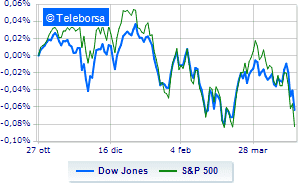

Among the US indices, sharp decline in Dow Jones (-1.88%), which reached 33,408 points; along the same lines, sales on theS & P-500, which continues the day at 4,202 points, down sharply by 2.19%. Heavy on Nasdaq 100 (-3.16%); on the same trend, depressed theS&P 100 (-2.47%).

The sector is in good evidence in the S&P 500 power. Among the worst on the list of the S&P 500, the sectors showed the greatest decline secondary consumer goods (-4.38%), informatics (-2.89%) e telecommunications (-2.84%).

Unique among the Blue Chips of the Dow Jones to report a significant increase is Chevron (+ 0.65%).

The worst performances, on the other hand, are recorded on Nikewhich gets -5.18%.

Breathless Boeingwhich falls by 4.62%.

Thud of 3Mwhich shows a drop of 3.52%.

Letter on Visawhich records a significant decline of 3.32%.

Between protagonists of the Nasdaq 100, Cadence Design Systems (+ 1.89%) e O’Reilly Automotive (+ 0.62%).

The strongest falls, on the other hand, occur on Tesla Motorswhich continues the session with -11.04%.

Goes down Lucidwith a drop of 8.59%.

Collapses Oktawith a decrease of 6.13%.

Sales hands on Docusignwhich suffers a decrease of 5.68%.

Between macroeconomic quantities most important of the US markets:

Tuesday 26/04/2022

14:30 USA: Durable goods orders, monthly (1% expected; previous -1.7%)

15:00 USA: FHFA house price index, monthly (previous 1.6%)

15:00 USA: S&P Case-Shiller, annual (expected 19%; previous 19.1%)

4:00 pm USA: New house sales, monthly (previous -1.2%)

4:00 pm USA: Consumer confidence, monthly (108 points expected; preceding 107.6 points).