(Finance) – Caution prevails on Wall Street, after the monthly report on the American labor market, much better than expected, which did not affect investor sentiment much.

The spotlight remains on the banking sector after the declines on the eve of the financial difficulties of the Silicon Valley Bank and the bankruptcy of the institute active in cryptocurrencies Silvergate. The two US institutes are relatively small in size, but have strong interconnections in the tech and startup ecosystem.

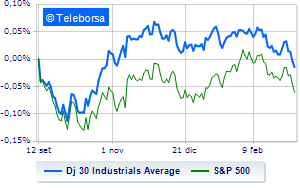

Among US indices, the Dow Jones the session continues with a slight drop of 0.22%; along the same lines, theS&P-500 it has a depressed trend and trades below the previous levels at 3,907 points. On equality the NASDAQ 100 (-0.11%); on the same trend, without direction theS&P 100 (-0.19%).

All sub-funds of the S&P 500 are down on Wall Street. In the lower part of the classification of the S&P 500 basket, significant declines are financial (-1.47%) and informatics (-0.45%).

Unique among the Blue Chips of the Dow Jones to report a significant increase is intel (+1.77%).

The worst performances, however, are recorded on JP Morganwhich gets -5.41%.

Prey of sellers Walgreens Boots Alliance,with a decrease of 3.45%.

Basically unchanged Walt Disneywhich reports a moderate -3.18%.

Stay close to parity Caterpillar (-3.12%).

Between best performers of the Nasdaq 100, intel (+1.77%), Constellation Energy (+0.73%) and Vertex Pharmaceuticals (+0.60%).

The strongest sales, on the other hand, show up JD.comwhich continues trading at -11.28%.

Hands-on sales Pdd Holdings Inc. Sponsored Adrwhich suffers a decrease of 7.93%.

Bad performance for CrowdStrike Holdingswhich records a drop of 5.62%.

Black session for Marvell Technology,which leaves a loss of 5.19% on the table.

Among the data relevant macroeconomics on US markets:

Friday 03/10/2023

2.30pm USA: Variation in employment (expected 205K units; previous 504K units)

2.30pm USA: Unemployment rate (expected 3.4%; previous 3.4%)

Tuesday 03/14/2023

1.30pm USA: Consumption prices, annual (previous 6.4%)

1.30pm USA: Consumption prices, monthly (previously 0.5%)

Wednesday 03/15/2023

1.30pm USA: Empire State Index (previously -5.8 points).