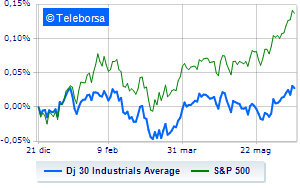

(Finance) – Caution prevails on Wall Street, with the Dow Jones which continues the session with a slight drop of 0.57%; along the same lines, slightly decreasingS&P-500, which continues the day below parity at 4,393 points. Consolidate the levels of the eve the NASDAQ 100 (-0.08%); with similar direction, on parity theS&P 100 (-0.19%).

Investors’ attention remains focused on central banks, after the Chinese central bank cut the cost of money by reducing the two key rates used to estimate consumption and the economic cycle. During the week we will look at the decisions of the Bank of England and the Swiss central bank, while tomorrow we expect the intervention of the president of the Federal Reserve, Jerome Powell, in the United States House.

The sector stands out in the S&P 500 basket secondary consumer goods. In the price list, the sectors power (-2.52%), materials (-1.42%) and industrial goods (-0.71%) are among the best sellers.

At the top of the rankings American giants components of the Dow Jones, United Health (+1.93%), Salesforce (+1.61%), Merck (+0.90%) and Apple (+0.52%).

The worst performances, however, are recorded on intelwhich gets -3.75%.

Prey of sellers boeingwith a decrease of 3.39%.

They focus their sales on Nikewhich suffers a drop of 3.01%.

Sales on Chevronswhich records a drop of 2.68%.

To the top between Wall Street tech giantsthey position themselves Rivian Automotive (+4.84%), PayPal (+3.78%), Tesla Motors (+3.36%) and Nvidia (+1.55%).

The strongest sales, on the other hand, show up PDD Holdingswhich continues trading at -8.01%.

Bad sitting for JD.comwhich drops by 7.48%.

Sensitive losses for Enphase Energydown 5.93%.

Bad sitting for intelwhich shows a loss of 3.75%.