(Finance) – Caution prevails on Wall Street which sees the rebound attempt fail even today, after three sessions to the downside and while the American Central Bank does not seem oriented to loosen its grip on rates, which, as the official Mester said, they could reach over 4% in 2023.

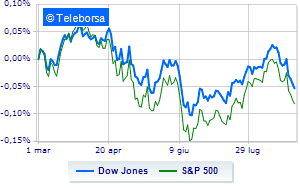

Among the US indices, the Dow Jones the session continues with a slight decrease of 0.26%, while, on the contrary, a day without infamy and without praise for theS & P-500, which remains at 3,980 points. Without direction the Nasdaq 100 (-0.04%); with the same direction, almost unchanged theS&P 100 (-0.12%).

Significant upside in the S&P 500 for the fund telecommunications. Among the worst on the list of the S&P 500 basket, the sectors showed the greatest decline materials (-0.72%) e secondary consumer goods (-0.45%).

Between protagonists of the Dow Jones, Walgreens Boots Alliance (+ 1.18%), Amgen (+ 0.84%) e McDonald’s (+ 0.70%).

The strongest falls, on the other hand, occur on Merckwhich continues the session with -1.31%.

Sales focus on Salesforcewhich suffers a decline of 1.22%.

Sales on Intelwhich recorded a decline of 1.19%.

Moderate contraction for Verizon Communicationwhich suffers a drop of 0.93%.

To the top between tech giants of Wall Streetthey position themselves Pinduoduo Inc Spon Each Rep (+ 6.05%), Baidu (+ 5.96%), Meta Platforms (+ 4.11%) e JD.com (+ 3.31%).

The strongest falls, on the other hand, occur on Crowdstrike Holdingswhich continues the session with -5.49%.

Collapses Advanced Micro Deviceswith a decrease of 2.76%.

Sales hands on Nvidiawhich suffers a decrease of 2.49%.

Bad performance for Lululemon Athleticawhich recorded a decline of 2.49%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Wednesday 31/08/2022

14:15 USA: ADP employed (formerly 270K units)

15:45 USA: PMI Chicago (expected 52 points; preceding 52.1 points)

16:30 USA: Oil stocks, weekly (expected -1.48 Mln barrels; prev. -3.28 Mln barrels)

Thursday 01/09/2022

13:30 USA: Challenger layoffs (formerly 25.81K units)

14:30 USA: Unit labor cost, quarterly (expected 10.7%; previous 12.6%).