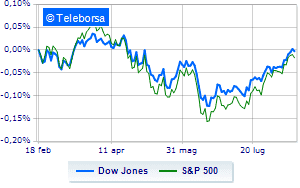

(Finance) – Caution prevails on Wall Street, with the Dow Jones which continues the session with a slight decrease of 0.53%, thus cutting the bullish trail supported by five consecutive gains, which began last Wednesday; on the same line, theS & P-500 lost 0.77%, continuing the session at 4,272 points.

Negative changes for the Nasdaq 100 (-1.3%); as well, under parity theS&P 100which shows a decline of 0.68%.

The sector stands out in the S&P 500 basket power. Among the most negative on the list of the S&P 500 basket, we find the sectors materials (-1.57%), telecommunications (-1.52%) e secondary consumer goods (-1.24%).

Between protagonists of the Dow Jones, Merck (+ 1.21%), Chevron (+ 1.17%), IBM (+ 0.66%) e Apple (+ 0.63%).

The worst performances, on the other hand, are recorded on Boeingwhich gets -3.05%.

Thud of Walgreens Boots Alliancewhich shows a 2.43% drop.

Under pressure 3Mwhich shows a decline of 1.95%.

It slips Visawith a clear disadvantage of 1.81%.

Apple is the only positive performance of the Nasdaq-100with an increase of 0.63%.

The worst performances, on the other hand, are recorded on Zoom Video Communicationswhich gets -5.93%.

Letter on Analog Deviceswhich records a significant decline of 5.54%.

Goes down Modernwith a drop of 5.48%.

Collapses Docusignwith a decrease of 5.32%.

Between macroeconomic variables most important in the North American markets:

Wednesday 17/08/2022

14:30 USA: Retail sales, monthly (expected 0.1%; previous 0.8%)

14:30 USA: Retail sales, annual (previous 8.5%)

4:00 pm USA: Industrial inventories, monthly (expected 1.4%; previous 1.6%)

4:00 pm USA: Industry sales, monthly (formerly 1%)

16:30 USA: Oil stocks, weekly (expected -275K barrels; prev. 5.46 Mln barrels).