(Finance) – The Wall Street stock exchange crosses the finish line in mid-session with the indexes traveling in positive territory, while the fears for the war in Ukraine. The attention of the operators, in addition to the quarterly season just started, she remains focused on Federal Reserve and they estimate an interest rate hike of 50 basis points.

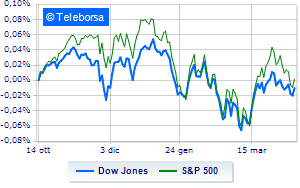

Among the US indices, the Dow Jones shows a fractional gain of 0.65%; on the same line, theS & P-500 it gained 0.77% compared to the previous session, trading at 4,431 points. On the rise the Nasdaq 100 (+ 1.5%); with the same direction, theS&P 100 (+ 0.76%).

The sub-funds are highlighted on the North American S&P 500 list secondary consumer goods (+ 2.01%), informatics (+ 1.12%) e power (+ 1.06%). At the bottom of the ranking, significant falls are manifested in the sector utilitieswhich reports a decrease of -0.42%.

To the top between giants of Wall Street, Boeing (+ 3.40%), Wal-Mart (+ 2.13%), American Express (+ 1.86%) e Nike (+ 1.58%).

The strongest falls, on the other hand, occur on JP Morganwhich continues the session with -3.17%.

Travelers Company drops by 1.21%.

On the podium of the Nasdaq titles, Pinduoduo Inc Spon Each Rep (+ 7.50%), Marriott International (+ 7.21%), Zscaler (+ 7.18%) e Modern (+ 7.09%).

The worst performances, on the other hand, are recorded on Paypalwhich gets -3.79%.

Heavy Synopsyswhich marks a drop of -3.51 percentage points.

Moderate contraction for Cognizant Technology Solutionswhich suffers a decline of 0.82%.

Undertone Xcel Energy which shows a filing of 0.64%.

Between macroeconomic quantities most important of the US markets:

Wednesday 13/04/2022

14:30 USA: Production prices, monthly (expected 1.1%; previous 0.9%)

14:30 USA: Production prices, annual (expected 10.6%; previous 10.3%)

16:30 USA: Oil stocks, weekly (863K barrels expected; previous 2.42 million barrels)

Thursday 14/04/2022

14:30 USA: Retail sales, annual (previous 17.6%)

14:30 USA: Retail sales, monthly (expected 0.6%; previous 0.3%).