(Tiper Stock Exchange) – Wall Street erases most of the declines registered at the beginning of the session, after i Macroeconomic data showed a tight job market, which therefore could give reason to the Federal Reserve to continue with its aggressive monetary policy. The US Bureau of Labor Statistics reported that in January there was a increase of 517 thousand new jobs (in non-agricultural sectors), much higher than the consensus (+185,000 new jobs), while the unemployment rate fell to 3.4% (expectations at 3.6%).

Contrasted trend among the tech giantsafter the release of the respective quarterly reports. Apple suffered weaker iPhone sales and manufacturing problems in China, the findings of alphabet were affected by the slowdown in online ad spending, while Amazon reported that the performance of its key cloud business fell slightly short of expectations.

Among those who released the data this morning, Cigna (US health and insurance company) reported above-expected quarterly earnings and increased dividend, Regeneron (US biotechnology and biopharmaceutical company) reported a better-than-expected quarter despite the decline in Covid-19 medicines, while aon (big name in insurance and reinsurance intermediation) reported a free cash flow 2022 at an all-time high.

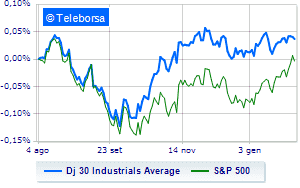

The New York Stock Exchange stops around parity, with the Dow Jones which stands at 34,119 points, while, on the contrary, theS&P-500 it has a depressed trend and trades below the previous levels at 4,171 points. Below parity the NASDAQ 100, which shows a decline of 0.35%; on the levels of the eveS&P 100 (-0.01%).

At the top of the rankings American giants components of the Dow Jones, American Express (+3.74%), Apple (+3.57%), JP Morgan (+2.33%) and Caterpillar (+2.17%).

The strongest declines, however, occur on Home Depot, which continues the session with -1.98%. Slide 3M, with a clear disadvantage of 1.65%. In red Honeywell International, which shows a marked decrease of 1.63%. It moves below parity Walgreens Boots Alliance,showing a decrease of 1.15%.

On the podium of the Nasdaq stocks, Tesla Motors (+4.50%), Gilead Sciences, (+4.26%), Regeneron Pharmaceuticals (+3.86%) and Apple (+3.57%).

The strongest sales, on the other hand, show up Atlassian, which continues trading at -6.50%. Breathless Datadog, which falls by 5.24%. Thump of Amazon, which shows a fall of 4.44%. Letter about Intuitionwhich records a significant drop of 4.09%.