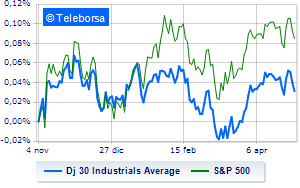

(Finance) – The New York Stock Exchange stops around parity, with the Dow Jones which stands at 33,707 points, while, on the contrary, theS&P-500 proceeds in small steps, advancing to 4,130 points. Just above parity the NASDAQ 100 (+0.25%); on the same trend, fractional gains for theS&P 100 (+0.23%).

The market is expecting the Federal Reserve’s verdict shortly, estimating a rate hike of 25 basis points. Insiders are mainly awaiting indications for the next few months, in the light of today’s data on American jobs which confirmed a resilient market, despite the layoffs of recent weeks.

In the background also remains the debate on the increase of debt ceiling underway in Congress, while US President Biden has announced that he does not intend to negotiate on public spending cuts, requested in return by the Republican House to avoid default.

Appreciable rise in the S&P 500 for the sub-funds utilities (+0.87%), sanitary (+0.65%) and telecommunications (+0.50%). At the bottom of the ranking, significant declines are manifested in the sector powerwhich reports a decrease of -0.57%.

At the top of the rankings American giants components of the Dow Jones, intel (+2.99%), Caterpillar (+1.54%), Walt Disney (+1.39%) and Verizon Communication (+1.13%).

The worst performances, however, are recorded on Walgreens Boots Alliancewhich gets -3.13%.

Slack Amgenwhich shows a small decrease of 1.03%.

Modest descent for JP Morganwhich drops a small -0.8%.

Thoughtful Chevronsa fractional decline of 0.77%.

To the top between Wall Street tech giantsthey position themselves Verisk Analytics (+8.49%), IDEXX Laboratories (+4.32%), Kraft Heinz (+3.66%) and intel (+2.99%).

The worst performances, however, are recorded on Advanced Micro Deviceswhich gets -8.85%.

It collapses Starbuckswith a drop of 8.77%.

Hands-on sales Adobe Systemswhich suffers a decrease of 4.28%.

They focus their sales on Walgreens Boots Alliancewhich suffers a drop of 3.13%.

Among the data relevant macroeconomics on US markets:

Wednesday 03/05/2023

2.15pm USA: Occupied ADP (Expected 148K units; Previous 142K units)

3.45pm USA: Composite PMI (expected 53.5 points; previous 52.3 points)

3.45pm USA: PMI services (expected 53.7 points; previous 52.6 points)

4:00 pm USA: ISM non-manufacturing (exp. 51.8 points; previous 51.2 points)

4.30pm USA: Oil inventories, weekly (exp -1.1 Mln barrels; prev -5.05 Mln barrels).