(Finance) – Wall Street reverses course and moves into positive territory at the end of a difficult and highly volatile week.

On the macro front, the cost of labor in the fourth quarter increased by 1%, less than the 1.2% forecast by experts and after the record figure (+ 1.3%) of the third quarter. The sharp rise in wages was one of the factors that most prompted the Federal Reserve Bank to abandon an accommodative monetary policy.

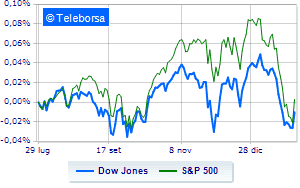

Among the American indices, the Dow Jones shows an increase of 0.35%; along the same lines, positive performance forS & P-500, which continues the day with an increase of 0.96% compared to the end of the previous session. High on the Nasdaq 100 (+ 1.66%); with the same direction, theS&P 100 (+ 1.3%).

Positive result in the S&P 500 basket for sectors Informatics (+ 2.61%), telecommunications (+ 1.45%) e sanitary (+ 0.87%). In the list, the sectors power (-1.59%), materials (-0.87%) e industrial goods (-0.68%) are among the best sellers.

At the top of the ranking of American giants components of the Dow Jones, Visa (+ 8.14%), Apple (+ 5.69%), Salesforce.Com (+ 3.22%) e Verizon Communication (+ 1.98%).

The strongest sales, on the other hand, show up on Caterpillarwhich continues trading at -5.44%.

Dramatic sitting for Chevronwhich falls by 4.59%.

Sensitive losses for 3Mdown 4.35%.

Breathless Intelwhich falls by 2.22%.

Between protagonists of the Nasdaq 100, Bed Bath & Beyond (+ 12.44%), Discovery (+ 6.54%), Discovery (+ 6.39%) e Apple (+ 5.69%).

The strongest falls, on the other hand, occur on Garminwhich continues the session with -10.69%.

Thud of Western Digitalwhich shows a fall of 7.54%.

Letter on American Airlineswhich records a significant decline of 2.85%.

It sinks Mondelez Internationalwith a fall of 2.70%.