(Finance) – After an upward start, the Wall Street indices, pushed by the quarterly figures, go negative. On the macroeconomic front, new weekly claims for unemployment benefits fell more than expected, while the Philadelphia Fed manufacturing index showed that prices paid have risen to their highest since June 1979 and that employment has risen to a record level.

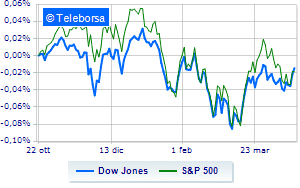

Among the US indices, the Dow Jones shows a variation equal to -0.13%; while, on the contrary, theS & P-500, which continues the day below par at 4,438 points. Just below parity the Nasdaq 100 (-0.66%); on the same line, below parity theS&P 100which shows a decline of 0.32%.

Positive result in the S&P 500 basket for the sector consumer goods for the office. Among the most negative on the S&P 500 list, we find the sectors telecommunications (-1.54%), power (-1.50%) e utilities (-1.01%).

Between protagonists of the Dow Jones, DOW (+ 4.20%), IBM (+ 2.12%), Verizon Communication (+ 1.74%) e Walgreens Boots Alliance (+ 1.10%).

The strongest falls, on the other hand, occur on Chevronwhich continues the session with -2.90%.

At a loss Salesforcewhich falls by 2.36%.

Decline for Goldman Sachswhich marks a -1.08%.

Under pressure Home Depotwith a sharp fall of 1.03%.

To the top between tech giants of Wall Streetthey position themselves Tesla Motors (+ 6.07%), CSX (+ 2.44%), Monster Beverage (+ 2.38%) e Kraft Heinz (+ 2.12%).

The strongest falls, on the other hand, occur on Align Technologywhich continues the session with -7.09%.

Heavy Matchwhich marks a drop of as much as -6.15 percentage points.

Negative sitting for Pinduoduo Inc Spon Each Repwhich falls by 5.60%.

Sensitive losses for JD.comdown 5.38%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Thursday 21/04/2022

14:30 USA: PhillyFed (expected 21 points; preceding 27.4 points)

14:30 USA: Unemployment Claims, Weekly (Expected 180K Units; Previously 186K Units)

4:00 pm USA: Leading indicator, monthly (expected 0.3%; preceding 0.6%)

Friday 22/04/2022

15:45 USA: Manufacturing PMI (expected 58.2 points; preceding 58.8 points)

15:45 USA: PMI services (expected 58 points; precedent 58 points).