(Finance) – Caution prevails on Wall Street, with investors’ attention remaining focused on central banks, after last week’s directive, with the Federal Reserve indicating that it expects to raise rates on the dollar once again before of the end of the year.

In the background, what worries the experts is also the failure to reach an agreementat the moment, between Republicans and Democrats to finance the government and avoid the shutdown, i.e. the closure of non-essential federal activities, which would start on October 1st.

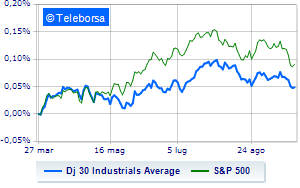

Among US indices, the Dow Jones the session continues with a slight drop of 0.50%; along the same lines, theS&P-500 loses 0.79%, continuing the session at 4,303 points. Negative the Nasdaq 100 (-0.97%); as well as, negative variations for theS&P 100 (-0.89%).

Negative performance in the States across all sectors of the S&P 500. Among the worst on the list of the S&P 500 basket, the sectors fell the most telecommunications (-1.23%), informatics (-1.07%) e secondary consumer goods (-1.07%).

The only Blue Chip of the Dow Jones is substantially up Merck (+0.6%).

The strongest sales, however, occur at Goldman Sachswhich continues trading at -1.01%.

He hesitates Applewith a modest decline of 0.95%.

Slow day for Microsoftwhich marks a decline of 0.82%.

Small loss for JP Morganwhich trades at -0.68%.

Between protagonists of the Nasdaq 100, Polished (+1.59%), Gilead Sciences (+1.42%) e Marriott International (+1.16%).

The steepest declines, however, occur at Sirius XM Radiowhich continues the session with -12.59%.

Under pressure Charter Communicationswhich suffered a decline of 2.27%.

It slides JD.comwith a clear disadvantage of 2.12%.

In red Cintas Corporationwhich highlights a sharp decline of 1.98%.