(Tiper Stock Exchange) – US stocks move lowerafter i Macroeconomic data showed a tight job market, which then could undermine the Federal Reserve’s efforts to slow inflation. The US Bureau of Labor Statistics reported that in January there was a increase of 517 thousand new jobs (in non-agricultural sectors), much higher than the consensus (+185,000 new jobs), while the unemployment rate fell to 3.4% (expected 3.6%).

In this week’s press conference, following the meeting in which the FOMC decided to raise rates by 25 basis points, Jerome Powell he had taken note of the current economic slowdown and used the term “disinflation” several times. Now the strong job market offers the US central bank room for stay aggressive with its monetary policy.

“Such data belies the narrative of central banks and above all the expectations of the markets – commented Filippo Diodovich, Senior Market Strategist of IG Italia – The US world of work remains strong, very strong, despite the restrictive moves of the Federal Reserve. Growth wage growth is showing to be consistent and will lead to further inflationary pressures central banks, and in particular the Federal Reserve, will have to make further efforts to bring inflation back towards the 2% target”.

There is also a weight on investor sentiment quarterly of the tech giantsarrived last night after the market closed. Apple suffered weaker iPhone sales and manufacturing problems in China, the findings of alphabet were affected by the slowdown in online ad spending, while Amazon reported that the performance of its key cloud business fell slightly short of expectations.

Among those who released the data this morning, Cigna (US health and insurance company) reported above-expected quarterly earnings and increased dividend, Regeneron (US biotechnology and biopharmaceutical company) reported a better-than-expected quarter despite the decline in Covid-19 medicines, while aon (big name in insurance and reinsurance intermediation) reported a free cash flow 2022 at an all-time high.

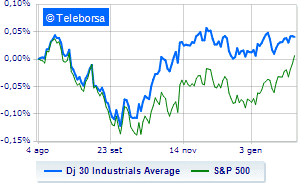

The Dow Jones files 0.28%; along the same lines, theS&P-500 it lost 0.89%, continuing the session at 4,142 points. depressed the NASDAQ 100 (-1.66%); with the same direction, down theS&P 100 (-0.98%).