(Finance) – US equity markets are extending their losses in today’s session, having recorded their worst day since the first wave of the pandemic in yesterday’s session. This followed the post-Fed rally, which proved to be only a momentary euphoria, with investors then reverting to assessing downside risks to the US and global economy. Meanwhile, in the United States they were created 428,000 non-farm jobs in April – more than expected analysts – bringing the workforce ever closer to pre-pandemic level.

Market participants meanwhile continue to wonder what implications the US central bank’s monetary policy will have on the real economy and in the financial field. “The FED will have to juggle nimbly in the coming months as it tries to tame the high inflation, without breaking the US economy – commented Allison Boxer, US Economist of PIMCO – Even if the economy starts from a position of strength, with stable balance sheets of households and businesses, we see downside risks to growth in a context characterized by a cycle of faster monetary tightening, the withdrawal of fiscal support, high geopolitical uncertainty, lockdowns in China and a depression in confidence levels, making it difficult to achieve the soft landing desired by the Fed “.

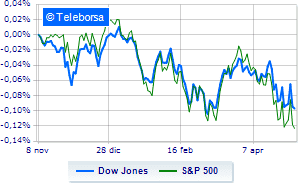

Wall Street moves downwith the Dow Jones which is leaving 0.66% on the parterre; on the same line, theS & P-500 he lost 0.83%, continuing the session at 4,112 points. In red the Nasdaq 100 (-1.16%); as well, downhill theS&P 100 (-0.85%). Positive result in the S&P 500 basket for the sector power. Among the most negative on the S&P 500 list, we find the compartments materials (-1.40%), secondary consumer goods (-1.39%) e telecommunications (-1.23%).

Between protagonists of the Dow Jones, Chevron (+ 0.99%) e McDonald’s (+ 0.69%).

The strongest sales, on the other hand, show up on Nikewhich continues trading at -4.39%.

Thud of Salesforcewhich shows a 2.33% drop.

Sales on Walt Disneywhich recorded a decline of 1.51%.

Negative sitting for Home Depotwhich shows a loss of 1.49%.

On the podium of the Nasdaq titles, Mercadolibre (+ 1.96%), Monster Beverage (+ 1.47%), Constellation Energy (+ 1.41%) e Charter Communications (+ 0.68%).

The worst performances, on the other hand, are recorded on Illuminatewhich gets -7.45%.

Letter on Matchwhich recorded a significant decline of 5.14%.

Goes down Lululemon Athleticawith a fall of 4.39%.

Collapses Zscalerwith a decrease of 4.20%.

Between macroeconomic variables most important in the North American markets:

Friday 06/05/2022

14:30 USA: Change in employees (expected 391K units; previous 428K units)

14:30 USA: Unemployment rate (expected 3.5%; previous 3.6%)

Monday 09/05/2022

4:00 pm USA: Wholesale stocks, monthly (previous 2.5%)

Wednesday 11/05/2022

14:30 USA: Consumption prices, annual (previous 8.5%)

14:30 USA: Consumption prices, monthly (expected 0.2%; previous 1.2%).