(Finance) – Wall Street stocks continue to fall after the data on the labor market, solid in the month of November, questioned among investors the prospects of a possible slowdown in the pace of rate hikes by the Federal Reserve , already from the meeting scheduled for this month.

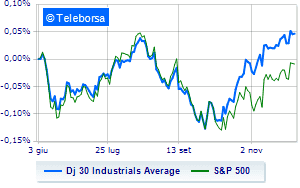

Among US indices, it moves below parity on Dow Jones, which drops to 34,262 points, with a percentage gap of 0.39%; along the same lines, theS&P-500, shedding 0.65%, trading at 4,050 points. In red the NASDAQ 100 (-1.14%); with the same direction, downhill theS&P 100 (-0.76%).

Negative result on Wall Street for all sectors of the S&P 500.

Among the best Blue Chips of the Dow Jones, boeing (+3.31%), Dow, (+0.67%), Nike (+0.62%) and Coke (+0.51%).

The strongest sales, on the other hand, show up intelwhich continues trading at -3.26%.

Prey of sellers Salesforce,with a decrease of 2.78%.

They focus their sales on JP Morganwhich suffers a drop of 1.59%.

It moves below parity Appleshowing a decrease of 1.43%.

Between protagonists of the Nasdaq 100, JD.com (+5.28%), Baidu (+4.44%), Pinduoduo, Inc. Sponsored Adr (+3.73%) and NetEase (+3.55%).

The strongest declines, however, occur on zscaler,which continues the session with -11.94%.

Black session for Datadogwhich leaves a loss of 5.10% on the table.

At a loss Okta,which drops by 4.76%.

Heavy Advanced Micro Deviceswhich marks a drop of as much as -4.65 percentage points.

Among the data relevant macroeconomics on US markets:

Friday 02/12/2022

2.30pm USA: Unemployment rate (expected 3.7%; previous 3.7%)

2.30pm USA: Variation in employment (expected 200K units; previous 284K units)

Monday 05/12/2022

3.45pm USA: PMI services (previous 46.1 points)

3.45pm USA: Composite PMI (previously 46.3 points)

4:00 pm USA: Industrial orders, monthly (0.8% expected; previous 0.3%).