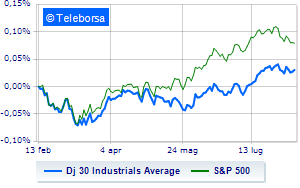

(Tiper Stock Exchange) – Contrasted session for the New York Stock Exchangewhich shows on Dow Jones an increase of 0.27%, while, on the contrary, theS&P-500 (New York), which stands at 4,464 points, close to the previous levels. Below parity the NASDAQ 100, which shows a decline of 0.66%; on parity theS&P 100 (-0.17%).

Appreciable rise in the S&P 500 for i compartments power (+1.63%), sanitary (+0.44%) and utilities (+0.43%). Among the worst of the S&P 500 list, the sub-funds are decreasing the most informatics (-0.80%) and telecommunications (-0.44%).

Investors find themselves evaluating data on producer prices stronger than expectedwhich fueled the worries about sticky inflation in the largest economy in the world. On the other hand, positive news came from the consumer price index yesterday, with headline inflation rising less than expected in July on an annual basis, reinforcing projections that the Federal Reserve could soon end its long campaign of policy tightening monetary.

Meanwhile, the season of quarterly is coming to an end. Among the most interesting data released in these hours are those of News Corpa media conglomerate founded by Rupert Murdoch, which reported falling data in the last financial year, signaling however a good performance of the Dow Jones division.

Among others corporate announcements, Cano Health communicated the cut of 17% of the workforce and expressed the will to arrive at a sale of the company, while Archer Aviation made a series of announcements solidifying its path to FAA certification and commercial operations in 2025.

Between protagonists of the Dow Jones, Chevrons (+1.63%), Merck (+1.32%), United Health (+1.21%) and Verizon Communication (+1.06%).

The strongest sales, on the other hand, show up Walt Disney, which continues trading at -2.15%. Modest descent for boeing, which drops a small -0.96%. Thoughtful Microsofta fractional decline of 0.69%.

Between protagonists of the Nasdaq 100, Palo Alto Networks (+2.36%), eBay (+2.29%), Regeneron Pharmaceuticals (+1.37%) and Constellation Energy (+1.07%).

The strongest sales, on the other hand, show up JD.com, which continues trading at -6.08%. Sensitive losses for PDD Holdings, down 4.39%. Breathless Illuminate, which falls by 4.24%. Thump of global foundrieswhich shows a drop of 3.98%.