(Tiper Stock Exchange) – Mixed performance for Wall Street, with Treasury yields rising and Nasdaq falling sharplyafter they arrived in recent days numerous hawkish statements by Federal Reserve officials, who signaled the need to stay on course in the process of tightening monetary policy, with the aim of stifling inflation that is still too high.

The Treasury bond sales have risen on speculation that i interest rates will be higher for longerlooking forward to next week’s inflation reading, which could provide further insights on the topic.

Meanwhile, the conclusion is approaching quarterly season, with more than half of the S&P 500 index companies releasing their results. Among the most important names left there are Coca Cola, AIG extension, Kraft Heinz And Applied materialswho will communicate their results next week.

Little move PayPal (US company that offers digital payment and money transfer services), which has achieved a quarterly above expectations and announced that CEO Dan Schulman will step down on December 31, 2023.

Instead, it sinks Lyft (competitor of Uber in the ride sharing sector), which communicated a disappointing guidance for the current quarter, despite the fact that the last three months of 2022 marked the record for revenues.

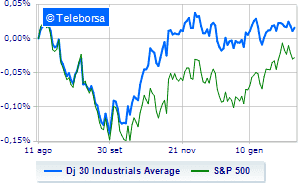

The Dow Jones is scoring a +0.3%, while, on the contrary, colorless theS&P-500, which continues the session at 4,078 points, on the previous day’s levels. Down the NASDAQ 100 (-0.98%); with similar direction, under parity theS&P 100which shows a decline of 0.27%.

To the top between Wall Street giants, Chevrons (+2.10%), United Health (+1.69%), Walgreens Boots Alliance, (+1.44%) and Merck (+1.33%).

The strongest declines, however, occur on Salesforce, which continues the session with -4.35%. In red Walt Disney, which shows a marked decrease of 2.04%. Undertone Visa showing a filing of 1.23%. Disappointing Microsoftwhich lies just below the levels of the eve.

Between protagonists of the Nasdaq 100, dexcom, (+10.70%), Diamondback Energy, (+3.68%), O’Reilly Automotive (+3.03%) and Kraft Heinz (+2.16%).

The worst performances, however, are recorded on AirBnb, which gets -6.47%. Goes down Tesla Motors, with a drop of 6.04%. It collapses Nvidia, with a decrease of 6.02%. Hands-on sales JD.comwhich suffers a decrease of 5.38%.