(Finance) – Wall Street continues session with fractional gain, confirming the cautious approach of the debut, awaiting a series of macroeconomic data and corporate results. The market has been pacing since last week after the Fed Chairman Jerome Powell has made it clear that a rate cut in March is unlikely.

However, the market awaits the release of the data on theUS inflationwhich will provide a more precise indication of the US central bank’s next moves.

Seat characterized byBitcoin exploitwhich reached close to 50 thousand dollars.

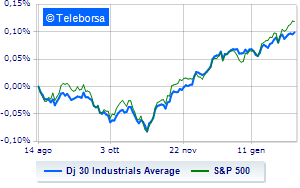

In New York the index Dow Jones rises by 0.53%, while theS&P-500 at 5,035 points. On the levels of the day before the Nasdaq 100 (-0.13%); on the same trend, consolidates the levels of the day beforeS&P 100 (+0.03%).

Positive result in the S&P 500 basket for sectors power (+1.22%), materials (+1.17%) e utilities (+1.12%). The sector informaticswith its -0.43%, is the worst of the market.

At the top of the rankings American giants components of the Dow Jones, Goldman Sachs (+2.86%), Intel (+2.52%), 3M (+2.19%) e Dow (+2.19%).

The worst performances, however, are recorded on Salesforcewhich marks -1.21%.

Disappointing Microsoftwhich lies just below the levels of the day before.

Lame Applewhich shows a small decrease of 0.53%.

Between best performers of the Nasdaq 100, Diamondback Energy (+9.52%), AirBnb (+5.22%), Trade Desk (+4.26%) e Charter Communications (+3.56%).

The strongest sales, however, occur at Constellation Energywhich continues trading at -3.16%.

Tesla Motors drops by 2.87%.

Decline decided for CrowdStrike Holdingswhich marks -2.38%.

Under pressure DexComwith a sharp decline of 2.09%.