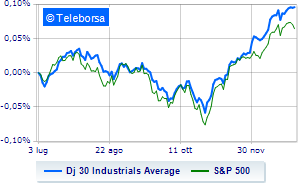

(Finance) – The New York Stock Exchange remains at parity, with the Dow Jones which stands at 37,748 points, while, on the contrary, theS&P-500, which retreats to 4,747 points. Depressed the Nasdaq 100 (-1.56%); as well, just below parity theS&P 100 (-0.63%).

The first session of 2024 confirms itself as weak, in the wake of investors taking profits after a year that closed with a strong rise. On the macroeconomic front, tomorrow the Minutes of the Fed’s latest monetary policy meetingwhile Friday is on the agenda labor market reportof the month of December.

In the S&P 500, the sectors performed well healthcare (+1.83%), power (+1.74%) e utilities (+1.45%). At the bottom of the S&P 500 ranking, significant declines are evident in the sectors informatics (-2.53%), telecommunications (-1.04%) e secondary consumer goods (-0.67%).

Between protagonists of the Dow Jones, Amgen (+3.89%), Merck (+3.55%), Walgreens Boots Alliance (+3.18%) e Verizon Communications (+3.17%).

The worst performances, however, are recorded on Intelwhich gets -4.25%.

Negative session for Applewhich shows a loss of 3.62%.

Under pressure Boeingwhich suffered a decline of 2.88%.

It slides Salesforcewith a clear disadvantage of 2.58%.

Between best performers of the Nasdaq 100, Modern (+15.21%), Warner Bros Discovery (+4.52%), Amgen (+3.89%) e Kraft Heinz (+3.32%).

The worst performances, however, are recorded on Advanced Micro Deviceswhich gets -5.62%.

Black session for JD.comwhich leaves a loss of 5.19% on the table.

At a loss Datadogwhich drops by 4.53%.

Heavy Atlassianwhich marks a decrease of -4.46 percentage points.