(Finance) – The Wall Street stock market continues with caution after weekly data on new unemployment benefits were in line with analysts’ estimates. Investors’ attention will now focus on the figures that will be released tomorrow, in particular the monthly data on the labor market and those on wage dynamics.

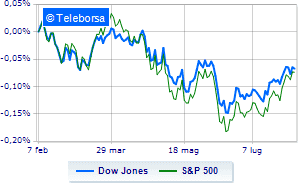

Among the US indices, the Dow Joneswhich drops to 32,746 points, with a percentage difference of 0.20%, while, on the contrary, theS & P-500, with the prices reaching 4,155 points. The Nasdaq 100 (+ 0.28%); consolidates the levels of the eve of theS&P 100 (-0.06%).

The sub-funds are highlighted on the North American S&P 500 list secondary consumer goods (+ 0.72%), industrial goods (+ 0.60%) e materials (+ 0.54%). In the list, the worst performances are those of the sectors power (-1.83%) e consumer goods for the office (-0.81%).

To the top between giants of Wall Street, Visa (+ 2.41%), 3M (+ 2.27%), Caterpillar (+ 1.34%) e American Express (+ 1.04%).

The strongest sales, on the other hand, show up on Wal-Martwhich continues trading at -3.03%.

Decline for JP Morganwhich marks a -1.86%.

Under pressure Verizon Communicationwith a sharp drop of 1.78%.

Goes down Intelwith a decrease of 1.67%.

Between protagonists of the Nasdaq 100, Mercadolibre (+ 16.28%), Advanced Micro Devices (+ 5.98%), Match (+ 5.34%) e Modern (+ 4.90%).

The strongest falls, on the other hand, occur on Fortinetwhich continues the session with -15.84%.

Collapses Lucidwith a decrease of 10.14%.

Sales hands on Palo Alto Networkswhich suffers a decrease of 5.87%.

Bad performance for Ebaywhich recorded a decrease of 5.33%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Thursday 04/08/2022

13:30 USA: Challenger layoffs (formerly 32.52K units)

14:30 USA: Balance of trade (expected -80.1 B $; previously -84.9 B $)

14:30 USA: Unemployment Claims, Weekly (Expected 259K Units; Previous 254K Units)

Friday 05/08/2022

14:30 USA: Change in employees (expected 250K units; previous 372K units)

14:30 USA: Unemployment rate (expected 3.6%; previous 3.6%).