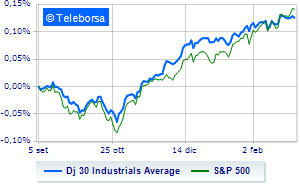

(Finance) – Caution prevails on Wall Street, after the indices reached historic highs in the last session. Week full of events and macro data, with the numbers on the labor market, Friday, and the testimony of Fed Chairman Jerome Powell in Congress, Wednesday and Thursday.

The Dow Jones the session continues with a slight drop of 0.25%, while, on the contrary, theS&P-500, which continues the day at 5,134 points. In fractional decline the Nasdaq 100 (-0.25%); on equality theS&P 100 (-0.18%).

Sectors are distinguished in the S&P 500 basket utilities (+0.77%), materials (+0.68%) e industrial goods (+0.50%). Among the worst performers on the S&P 500 list, the sectors fell the most telecommunications (-1.54%), secondary consumer goods (-1.07%) e power (-0.74%).

Among the best Blue Chips of the Dow Jones, Intel (+5.29%), IBM (+2.60%), Dow (+2.24%) e Goldman Sachs (+1.98%).

The steepest declines, however, occur at Applewhich continues the session with -3.13%.

Negative session for Chevronwhich shows a loss of 2.81%.

Under pressure Nikewhich suffered a decline of 2.39%.

It slides Merckwith a clear disadvantage of 2.38%.

To the top between Wall Street tech giantsthey position themselves Nvidia (+5.55%), Intel (+5.29%), DoorDash (+5.19%) e Constellation Energy (+3.41%).

The strongest sales, however, occur at Tesla Motorswhich continues trading at -7.18%.

Collapses Warner Bros Discoverywith a decrease of 6.00%.

Sales galore Workdaywhich suffers a decrease of 5.75%.

Bad performance for Charter Communicationswhich recorded a decline of 5.37%.