(Finance) – A cautiously rising start for the US stock market which is about to conclude a week where the central banks were once again the protagonists.

Investors continue to evaluate the impact of Fed decisions, i.e., elevated rate levels for an extended period of time.

After the central banks of Switzerland and the United Kingdom left the reference rates unchanged, while that of Norway and Sweden raised them by a quarter of a point. Today, at the end of the eighth quarter, it was the Bank of Japan’s turn to confirm its ultra-accommodative position, signaling that it is in no hurry to withdraw the stimulus to the economy.

The attention of insiders is also focused on the lack of agreement between Republicans and Democrats to finance the government and avoid the shutdown, i.e. the closure of non-essential federal activities, which would start on October 1st.

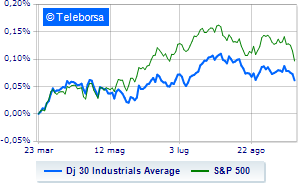

Among US indices, the Dow Jones it stands at 34,062 points on the day before; along the same lines, theS&P-500 remains at 4,338 points. Just above parity the Nasdaq 100 (+0.31%); on equality theS&P 100 (+0.15%).

Positive result in the S&P 500 basket for sectors power (+1.09%), materials (+0.58%) e secondary consumer goods (+0.51%). At the bottom of the ranking, significant declines are evident in the sector utilitieswhich reports a decline of -0.52%.

The only Blue Chip of the Dow Jones is substantially up United Health (+1.83%).

The strongest sales, however, occur at Cisco Systemswhich continues trading at -3.89%.

Nothing done yet Dowwhich changes hands on parity.

Colorless Nikewhich did not record significant changes compared to the previous session.

Without momentum Caterpillarwhich trades with -2.36%.

Between protagonists of the Nasdaq 100, Kraft Heinz (+1.38%), Enphase Energy (+0.71%), Vertex Pharmaceuticals (+0.56%) e eBay (+0.53%).

The worst performances, however, are recorded on Atlassianwhich gets -5.41%.

Black session for Dollar Treewhich leaves a loss of 5.21%.

At a loss Polishedwhich fell by 5.14%.

Heavy Amazonwhich marks a decrease of -4.41 percentage points.

Among macroeconomic events which will have the greatest influence on the performance of the US markets:

Friday 09/22/2023

3.45pm USA: Composite PMI (previously 50.2 points)

3.45pm USA: Manufacturing PMI (expected 48 points; previously 47.9 points)

3.45pm USA: Services PMI (expected 50.6 points; previously 50.5 points)

Tuesday 09/26/2023

3pm USA: S&P Case-Shiller, annual (prev. -1.2%)

3pm USA: FHFA Home Price Index, monthly (previously 0.3%).