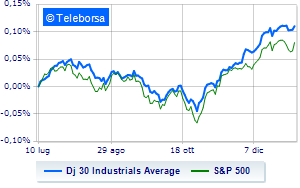

(Finance) – Caution prevails on Wall Street, with the Dow Jones which continues the session with a slight drop of 0.43%, stopping the series of three consecutive increases that began last Thursday, while, on the contrary, a day without infamy and without praise for theS&P-500, which remains at 4,760 points. In fractional progress the Nasdaq 100 (+0.26%); consolidates the levels of the day beforeS&P 100 (+0.06%).

Investors’ attention is always focused on the data on American inflation, expected on Thursday, to understand what the central banks’ next moves will be. The latest employment report, which showed a stronger-than-estimated labor market, led industry insiders to reduce expectations of a first rate cut as early as March.

Focus also on the new season of quarterly reports, starting on Friday, which will start with the big banks.

The sector is highlighted on the North American S&P 500 list informatics. At the bottom of the ranking, the greatest declines occur in the sectors power (-1.46%), materials (-1.00%) e financial (-0.65%).

To the top between giants of Wall Street, Merck (+0.81%) e Salesforce (+0.73%).

The worst performances, however, are recorded on Chevronwhich gets -2.03%.

Negative session for Dowwhich shows a loss of 1.93%.

Under pressure Walt Disneywhich suffered a decline of 1.57%.

It slides Cisco Systemswith a clear disadvantage of 1.54%.

Between best performers of the Nasdaq 100, Illuminate (+5.73%), CrowdStrike Holdings (+5.61%), Zscaler (+3.88%) e Palo Alto Networks (+3.65%).

The steepest declines, however, occur at Modernwhich continues the session with -4.44%.

Bad performance for Polishedwhich recorded a decline of 3.95%.

In red GE Healthcare Technologieswhich highlights a sharp decline of 3.12%.

The negative performance of Warner Bros Discoverywhich falls by 2.68%.