(Finance) – The Wall Street stock exchange continues positive, but with caution. Investors are moving cautiously with their eyes on US inflation on the agenda tomorrow and the start of the quarterly season in the US, starting Thursday. Insiders fear disappointing results and outlook due to rising prices and supply chain problems.

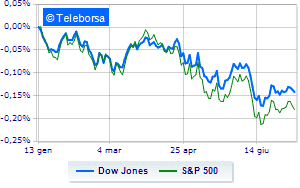

Among the US indices, the Dow Jones shows a fractional gain of 0.25%, while, on the contrary, colorless theS & P-500, which continues the session at 3,853 points, on the eve of the eve. Without direction the Nasdaq 100 (+ 0.02%); as well as, almost unchangedS&P 100 (-0.04%).

Financial (+ 0.71%), materials (+ 0.71%) e telecommunications (+ 0.69%) in good light on the S&P 500 list. In the list, the worst performances are those of the sectors power (-1.80%) e sanitary (-0.83%).

Among the best Blue Chips of the Dow Jones, Boeing (+ 8.31%), Walgreens Boots Alliance (+ 2.26%), Apple (+ 2.07%) e Honeywell International (+ 1.74%).

The strongest sales, on the other hand, show up on Salesforcewhich continues trading at -3.95%.

Breathless Microsoftwhich falls by 2.97%.

Suffers Chevronwhich shows a loss of 1.75%.

Basically weak Johnson & Johnsonwhich recorded a decrease of 0.93%.

Between best performers of the Nasdaq 100, Charter Communications (+ 4.54%), Lucid (+ 4.05%), Pinduoduo Inc Spon Each Rep (+ 3.69%) e Micron Technology (+ 3.08%).

The strongest sales, on the other hand, show up on Atlassianwhich continues trading at -7.76%.

Thud of Zscalerwhich shows a fall of 6.13%.

Letter on Datadogwhich records a significant decline of 5.11%.

Goes down Crowdstrike Holdingswith a decrease of 4.75%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Wednesday 13/07/2022

14:30 USA: Consumer prices, annual (expected 8.8%; previous 8.6%)

14:30 USA: Consumption prices, monthly (expected 1.1%; previous 1%)

16:30 USA: Oil stocks, weekly (previous 8.24 million barrels)

Thursday 14/07/2022

14:30 USA: Production prices, annual (expected 10.7%; previous 10.8%)

14:30 USA: Production prices, monthly (expected 0.8%; previous 0.8%).